REFINANCING YOUR RESIDENTIAL MORTGAGE

Why? When? Cautions! What’s the Point of “Points”?

September 2017

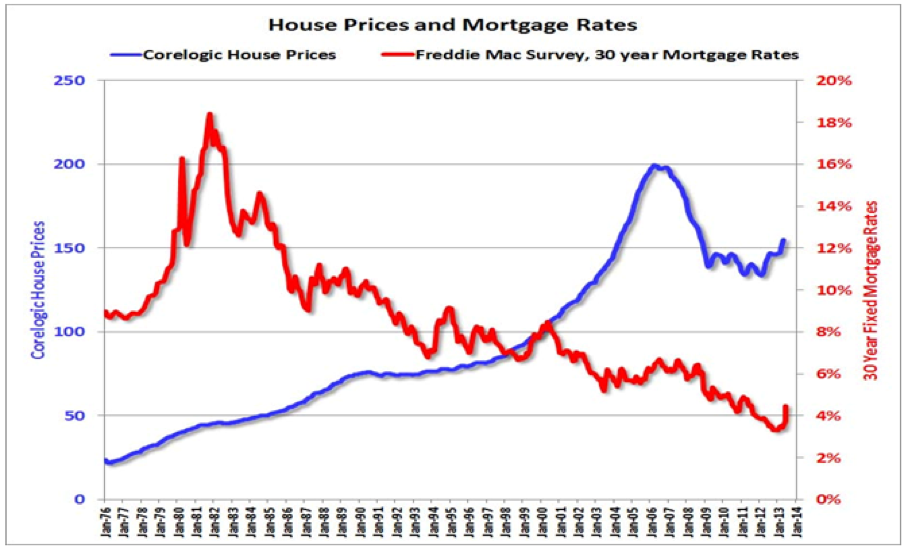

Mortgage rates remain at record lows and home prices have steadily increased since the bubble burst in 2006 – 2008. So many homeowners are considering refinancing their current mortgage for a variety of reasons. Most often the decision is based on one or more of the following:

• Enjoy a new mortgage with a lower interest rate than your current home loan.

• Convert an adjustable rate mortgage to a fixed rate to keep payments from increasing.

• Consolidate high interest debt.

• Free up cash from the equity in your home for purchases or investments.

• Reduce the term of your loan, e.g. from 30 years to 15 years.

Why & When Should You Consider to Refinance?

If you are thinking about refinancing, the place to start is to see if it makes economic sense in your specific circumstances. There are costs associated with obtaining a new mortgage that include closing costs and other charges such as application fee, title search and title or escrow fees. There also may be loan origination points as well as pre-payment penalties payable to your existing lender.

A simple calculation is to:

• Calculate the total cost of the refinance (A).

• Calculate your monthly savings (B).

• Divide A by B.

This will determine your “break-even” point of how many months it will take to recoup your costs to refinance. So if you own your home longer than this, you will save money by refinancing. If your plan is to move before realizing your break-even point, a refinance probably does not make sense.

Of course, this is somewhat of an oversimplification as there may be lost opportunity costs for money applied to refinancing expenses as well as tax considerations.

Lost Opportunity Costs

Lost opportunity costs refer to alternative uses for equity that may be freed up via refinancing. Typically those missed opportunities come down to making more money or enjoying a liquid source of immediate cash.

Making more money refers to the opportunity to invest funds freed up by refinancing your home. The guiding principle is - if the anticipated rate of return on your planned investment exceeds the interest rate you will pay on your refinanced mortgage, then refinancing to reinvest is worth considering.

Another circumstance may arise that will result in a similar consideration. Let’s say you owe $100,000 on your current mortgage and received a net inheritance of $150,000. Should you pay off the mortgage? Maybe, but again think through whether you would be better off investing the inheritance. If the anticipated rate of return on your planned investment exceeds the interest rate on your current mortgage, then it probably pays to stick with the home loan you have.

Liquidity, or maintaining an immediate source of available cash, is a very real concern that you may want to address through refinancing. Instead of equity tied up in your home, it may be to your advantage to free up a portion or all of that illiquidity to provide a cushion for investment opportunities or to meet unexpected financial obligations, e.g. health care. That same option holds true for inherited funds as well.

Tax Considerations

Additionally, there may be tax consequences of refinancing to consider. Best bet … meet with your tax advisor to determine the best options for your unique situation.

As ever, Blair + Assoc will respond quickly to your request for guidance.

What to Watch Out For

Speaking of the costs to refinance, one that is often both overlooked and misunderstood by borrowers is a “prepayment penalty”. Simply put, a prepayment penalty is a mortgage agreement condition that dictates how much a borrower may pay to reduce the mortgage principal and how often that limit may apply.

Most mortgage lenders allow borrowers to pay off up to 20 percent of the loan balance each year. Why do lenders curb the prepayment amount? Real simple … it protects the lender who anticipates a profit based on the repayment terms of the mortgage. When loans are paid off more quickly than expected, the lender loses money.

So what does all this have to do with refinancing your home loan? If your existing loan provides for a prepayment penalty, paying off the existing loan with a more attractive alternative mortgage may (probably) result in a lump sum repayment in excess of the 20 percent threshold. That will trigger the prepayment penalty.

To put all this in perspective, most large banks don’t tack on prepayment penalties. Smaller lenders often do to help them compete on rate by offering a much lower interest rate in return for the potential of a prepayment penalty. So just be wary of what terms you agreed to when you signed on the dotted line for your current mortgage loan. You may have opted for a lower interest rate while, knowingly or unknowingly, accepting prepayment penalty terms.

Note: FHA loans do not include prepayment penalties. So if that’s yours … not to worry.

What’s the Point of “Points”

Lenders charge points as an added profit line item. In turn, the quid pro quo for borrowers is a lower mortgage interest rate in return for paying points.

What’s a point? Each point is equal to 1 percent of the loan amount. To make the math simple, 2 points on a $100,000 loan is $2,000.

In addition to a reduced interest rate, you may qualify for significant tax benefits in the form of deductions on your income tax return for all or part of points you paid. Cuts in your tax bill, as you likely expect, are subject to rules.

To claim a tax deduction for loan points on a refinanced loan here are two of the more important requirements.

• The loan is secured by your primary residence … the home you live in most of the time.

• You may not pay points in exchange for lower settlement fees, e.g. appraisals, inspections, title fees, attorney fees or property taxes.

In nearly every refinancing case, deductions for loan points must be amortized over the life of the loan.

There are exceptions. For example, proceeds used to improve the home may qualify to be deducted in the year paid.

Again, a need for clarification from your tax advisor.

Summary

The risk/reward ratio of refinancing really comes down to some practical economic analysis. In addition to the simple calculation of costs associated with refinancing offered above, there are other considerations. For example, if you refinance late in your current mortgage term, your new monthly payment will be applied mostly to interest which means added time for you to build additional equity in your home.

Like most things in our diverse economy that offers multiple options … it demands answers to multiple questions. Best bet … meet with your tax advisor to determine the best options for your unique situation.

As ever, Blair + Assoc will respond quickly to your request for guidance.

- GETTING READY TO RETIRE?

- STUDENT LOAN DEBT ACCELERATES

- SO YOU THINK YOU WANT TO START YOUR OWN BUSINESS

- MEDICAL EXPENSE TAX DEDUCTIONS

- NO ESTATE PLAN?

- CHARITABLE DONATIONS AND THE IRS

- DONE WELL WITH YOUR STOCKS/MUTUAL FUNDS?

- YOUR ANSWERS TO THREE QUESTIONS

- FINANCIAL AID FOR THE DISABLED

- SCHOOL DAYS, SCHOOL DAYS