Save Taxes and Accelerate Value to Your Favorite Charity

March 2017

If you own stocks or mutual funds, like most shareholders you have probably enjoyed significant appreciation in the value of your investments. These past few years have been good ones for buy-and-hold investors.

So you may be thinking about how you may “share the wealth” with one or more of your favorite charities. But wait! Before cashing in on your holdings to free up cash for a charitable contribution, consider a win-win alternative to save taxes while increasing the worth of your charitable giving.

How? Donate long-term, appreciated securities directly to charity.

Virtually any long-term appreciated securities - stocks, bonds and/or mutual funds - that were purchased over a year ago and have a current value greater than their original cost may be donated to a public charity and a tax deduction taken for the full fair market value of the securities … up to 30% of the donor’s adjusted gross income. This is an excellent way to give more plus save on both capital gains tax and potentially the Medicare surtax.

The net result is dollars that otherwise would have been paid in taxes are transferred directly to the charity of your choice … thus maximizing the power of your contribution to make a difference for the cause you support.

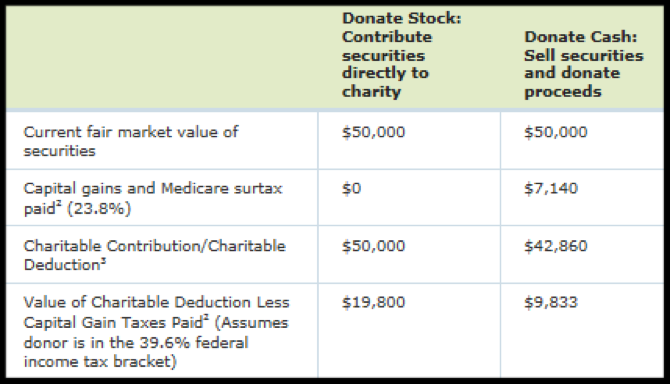

Here’s a hypothetical example of how it may work for you. The table below illustrates a couple with an adjusted gross income of $500,000, filing jointly. The comparison is the potential tax savings in making a direct donation of a long-term appreciated security with a cost basis (original cost) of $20,000, and long-term capital gains of $30,000 vs. selling the securities, paying taxes and donating what’s left.

Clearly, the result in this instance better than doubles the amount received by the charity!

Of course, the specific benefits of this charitable deduction will vary based on income, tax bracket and age. For example, capital gain tax rates range from 0% to 20% depending on your tax bracket. Remember, it may be of value to explore regardless of your level of income.

If you think this sounds like something that may benefit you as a charitable donor, please feel free to give us a call. We are happy to work with you to determine its value to you and your chosen charity.