Q1 + 1

End of First Quarter Plus a Month – The Revised Tax Code

Lessons Learned for Individuals & Businesses

April 2018

In our last three issues of the Blair Bulletin we outlined the key provisions of the Tax Cuts and Jobs Act (TCJA) as we understood them to be. Now we have four months of history to review and update on a better understanding of the real-world application of the new law along with clarifications from the IRS.

As anticipated, this Act is the most significant revision to the U.S. tax code in 3 decades and impacts virtually every American taxpayer … both individuals and businesses.

What follows deals with three major elements of the TCJA. As you’ll see, the first is quite positive, the second is as well … but with caution; the third may be a burden.

• 20 percent deduction for the self employed;

• Across the board individual tax cuts of 3 to 4 percent;

• Elimination of itemized deductions.

This article is intended only to generally highlight parts of the new law. Seeking advice from a professional tax expert is advised to determine the details of the application of the TCJA to both individuals and businesses.

Self-Employed 20% Deduction

Beginning in tax year 2018, many small business owners may be eligible to deduct 20% of their qualified business income (QBI). That means that qualifying pass-through entities will only be taxed on 80% of their pass-through income. Subject to certain definitions, restrictions and exceptions, this tax break applies to partnerships, S corporations and sole proprietorships.

Among the considerations for business owners to be aware of are:

• Taxable Income Limitations – Filing jointly or Singly

• Definition of Qualified Business Income (QBI)

• Specified Service Businesses – Included and Excluded Professions

• Wage and Capital Limitations of Specified Service Businesses

• Above-the-Line and Below-the-Line Deductions

• Standard vs. Itemized Deductions

• Eligibility for Independent Contractors – Full-time or “Side-hustle”

For a more detailed discussion of these 7 items and more, Click Here.

In addition to the above, there may be mitigating circumstances that can affect the amount of deduction an individual small business owner can take. For example, partners in a business may find that one owner gets the 20 percent deduction and the other doesn’t. That would be the case when a partner with a high-income spouse exceeds the taxable income threshold described above.

S Corporations present another wrinkle on the amount of the deduction. Owners of S Corporations must pay themselves “reasonable compensation”. The reason for this: The IRS does not want distributions to be in lieu of wages. Since S Corporations are not subject to self-employment tax, it would mean every dollar distributed as other than wages would avoid 15.3% in payroll taxes … potentially a major “hit” to revenue that supports Medicare and Social Security.

The net result under the new tax law is that “reasonable compensation” paid to the S Corporation taxpayer is excluded in computing qualified business income.

For a detailed comparative look at the differences in tax deductions based on three forms of small business structure, Sole Proprietor, S Corporation and Partnership, Click Here.

Caution: Don’t make any decisions about changing your current business structure or how to set up a new business. There is much more to consider than just the 20% pass through deduction. Seek advice from a professional tax expert.

Individual Tax Rates Cut 3 – 4% in Each Tax Bracket

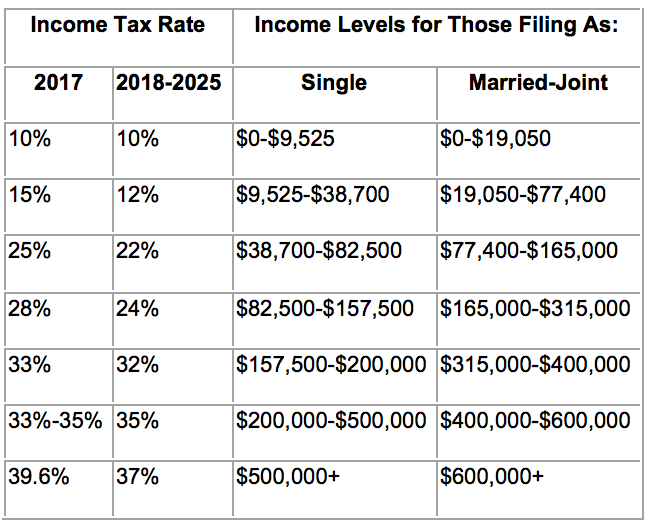

The Act retains the seven income tax brackets of the previous tax code, but with reduced tax rates for individuals in all brackets but one. The net effect of these reductions will be enjoyed by employees as they see reduced employer payroll withholding and larger take-home pay beginning with their February 2018 paychecks.

Comparison of New Tax Rates vs. Old

Note: Capital gains rates remain unchanged under the new law.

Caution: In the February 2018 issue of The Blair Bulletin we cautioned that while you may enjoy a bump in your take-home pay, it may also result in an unexpected higher bill for 2018 taxes. That means if you don’t withhold enough throughout the year, you may have an unpleasant surprise next spring, i.e. April 2019.

Here’s your answer. The IRS has released the Withholding Calculator to help you perform a quick “paycheck checkup” to make sure you have the right amount of tax withheld from your paycheck at work.

Here are two reasons to take advantage of this simple-to-use tool:

• Protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year.

• You may find it is to your advantage to have less tax withheld up front and receive more in your paychecks.

Next Steps: Gather the following information … won’t take more than a few minutes.

• Most recent pay stubs.

• Most recent income tax return, Form 1040.

Then click here and answer a few questions … Withholding Calculator

Your Withholding Calculator results will empower you to revise your W-4 information to minimize or eliminate any negative impact on your tax liability. If you need to give your employer a new Form W-4, Employee's Withholding Allowance Certificate, you can use your results from the Calculator to help fill out the form and adjust your income tax withholding.

Note: If your circumstances change during the year, revisit the Calculator to make sure your withholding is still correct.

For more immediate answers, or if your circumstances are complex, consult with a tax professional to make sure your withholdings are adequate to support a bigger paycheck now but not trigger a bigger tax bite at year end.

Bonus Clarification for Individual Taxpayers

There was some initial confusion on the deductibility of interest on home equity lines and lines of credit. The clarification: You may itemize and deduct interest on home equity loans and lines of credit only if the money is used to buy, build or substantially improve the home that secures the loan.

Elimination of Itemized Deductions

As of January 1, 2018, employees lost their ability to claim a deduction for unreimbursed business expenses. Previously, employees could potentially write off work-related expenses that added up to more than 2 percent of their gross income, and for which an employer didn't reimburse them.

Who will be those mainly affected by this loss in deductibility? Some examples … nurses can't write off their scrubs any more. Salespeople can't deduct their travel expenses. Professors can't subtract research costs. That means expenses that you incur in your job that are not reimbursed, like tools and supplies; required uniforms not suitable for ordinary wear; dues and subscriptions; and job search expenses.

This includes deductions for investment and tax preparation expenses.

Those are just a few examples on a long list of expenses that, under the old tax code, employees could potentially write off — provided that those were expenses for which their employer didn't reimburse them, and that added up to more than 2 percent of their gross income.

These expenses also include unreimbursed travel and mileage, as well as the home office deduction.

What this means is that employees, who until now were able to offset reimbursement through deductions on their personal income taxes, will no longer enjoy that as an option and may seek reimbursement from their employers as the financial equalizer.

Summary

Touted as the most comprehensive overhaul of the tax code in over three decades, the TCJA is also quite complex and subject to questions and interpretation.

As ever, Blair + Assoc stands ready to help!

Give us a call or an email. We’ll respond promptly.

- SMALL BUSINESS AND THE 20% PASS-THROUGH

- SMALL BUSINESS AND THE 20% PASS-THROUGH

- 90% OF AMERICANS WILL ENJOY MORE TAKE-HOME PAY

- 2018 … THE YEAR OF CHANGES TO … TAX RATES, DEDUCTIONS, EXEMPTIONS & CREDITS

- TAX SEASON…NEED NOT BE YOUR “TAXING” SEASON

- VA TAX CREDITS – COULD ANY BE BENEFICIAL FOR YOU?

- HURRICANES COME AND GO

- PAPERS, MEDS & PETS

- VIRGINIA TAXPAYERS WHO OWE BACK TAXES

- REFINANCING YOUR RESIDENTIAL MORTGAGE