The New Tax Law Delivers Tax-Saving Opportunities

But Not With Perfect Clarity

Second in a Series of (at least) Two Articles

March 2018

As we reported in the February 2018 Blair Bulletin, the new tax law – the Tax Cuts and Jobs Act (TCJA) – carves out a brand-new tax deduction for owners of pass-through entities including partners in partnerships, shareholders in S corporations, members of limited liability companies (LLCs) and sole proprietors.

Beginning in tax year 2018, many small business owners may be eligible to deduct 20% of their qualified business income (QBI). That means that qualifying pass-through entities will only be taxed on 80% of their pass-through income.

Of course there are definitions, restrictions and limitations based on your taxable income and the industry in which you work. That said, if your taxable income is under $315,000 (filing jointly) or $157,500 (filing single) the limitations do not apply to you. Essentially, taxpayers who are below those thresholds may take the deduction no matter what business they are in.

However keep in mind the deduction may be the lesser of 20 percent of your QBI or taxable income.

So in this article, we’ll address those of you who fit into this taxpayer category and some of the considerations that you need to think about to ensure you are positioned to take maximum advantage of the new law.

As in most things in life, there are mitigating circumstances that in this case can affect the amount of deduction an individual small business owner can take. For example, partners in a business may find that one owner gets the 20 percent deduction and the other doesn’t. That would be the case when a partner with a high-income spouse exceeds the taxable income threshold described above.

S Corporations present another wrinkle on the amount of the deduction. Owners of S Corporations must pay themselves “reasonable compensation”. The reason for this: The IRS does not want distributions to be in lieu of wages. Since S Corporations are not subject to self-employment tax, it would mean every dollar distributed as other than wages would avoid 15.3% in payroll taxes … potentially a major “hit” to revenue that supports Medicare and Social Security.

The net result under the new tax law is that “reasonable compensation” paid to the S Corporation taxpayer is excluded in computing qualified business income.

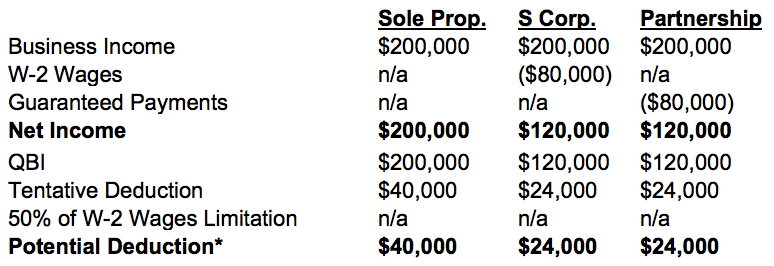

Let’s take a look at the differences in tax deductions based on three forms of small business structure, Sole Proprietor, S Corporation and Partnership.

Case Study

In the following Case Study, we’re presenting the facts as they appear to be under the TCJA. It is still “early days” in the new law and it will likely be subject to IRS guidance and interpretation as the year unfolds.

Pat is the sole owner of a business. In the Partnership example that follows, Pat owns 99% with 1% owned by Pat’s spouse. Pat has no employees, but does operate with the help of a few independent contractors.

We’ll assume that the business generates $200,000 of ordinary income in 2018. This is also Pat’s taxable 2018 income. Now let’s look at how Pat’s deduction varies based on whether the business is operated as a Sole Proprietor, S Corporation or Partnership.

*However keep in mind the deduction may be the lesser of 20 percent of your QBI or taxable income.

A bit of explanation will help. In the case of the S Corp. scenario, Pat receives “reasonable compensation” of $80,000. That reduces Pat’s QBI to $120,000. By way of contrast, as a Sole Proprietor, Pat would not be faced with a similar reduction to QBI so in this example would be preferentially treated.

As a Partnership, there is an interesting option to the example above. Pat is not required to take a “Guaranteed Payment”, but if taken it would reduce QBI much the same as the S Corp. scenario. Without the guaranteed payment, Pat’s QBI would mirror that of a Sole Proprietor.

Caution: Don’t make any decisions about changing your current business structure or how to set up a new business. There is much more to consider than just the 20% pass through deduction.

Planning is the No. 1 thing we're doing at Blair + Assoc for clients including doing a cost-benefit analysis when appropriate.

Just give us a call or drop an email. We’ll respond promptly!

Summary

The TCJA is the most comprehensive overhaul of the tax code in over thirty years. Clearly, the new law is quite complex and subject to questions and interpretation. There is little doubt that the IRS will soon issue guidance with regard to pass-through entities.

Stay tuned for a fairly steady stream of clarifications as the grey area questions are asked and answered. The Blair Bulletin will tackle the continuing news and events that surface regarding this new law and the significant tax breaks for qualifying small businesses.