GET READY TO GET READY FOR YOUR 2018 TAX FILING

Here’s a Primer to Prepare for Your Meeting with Your Tax Advisor

December 2018

Well here we are at the end of the first tax year under the Tax Cuts and Jobs Act (TCJA) ... regulations that impact virtually all taxpayers. The good news is that most taxpayers, both businesses and individuals, will enjoy tax savings under the new regulations. Nevertheless, end of year planning is critical to maximize your benefits and minimize your tax bite.

So the following is intended to provide you with information to have a meaningful meeting with your tax advisor as you file your 2018 return. We’ll take a look at the tax rates, tax deductions, exemptions and tax credits provided for in the TCJA for both individuals and businesses.

As ever, Blair + Assoc stands ready to help!

Give us a call or an email. We’ll respond promptly.

Read More to Go Here!!!

Individual Taxpayers

Note: Most individual changes are effective January 1, 2018 and will expire at the end of 2025.

Unless Congress passes another law prior to then, the old tax code provisions will be reinstated.

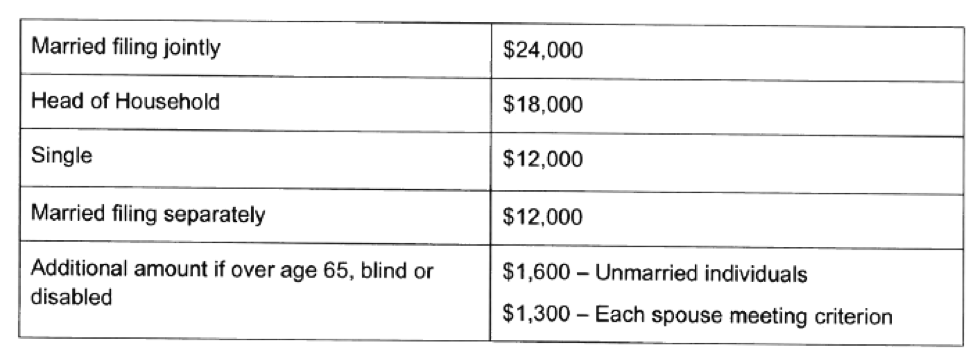

Among the changes affecting individual taxpayers include doubling the standard deduction, elimination of personal exemptions, and numerous itemized deductions reduced or eliminated.

Individual Income Taxes

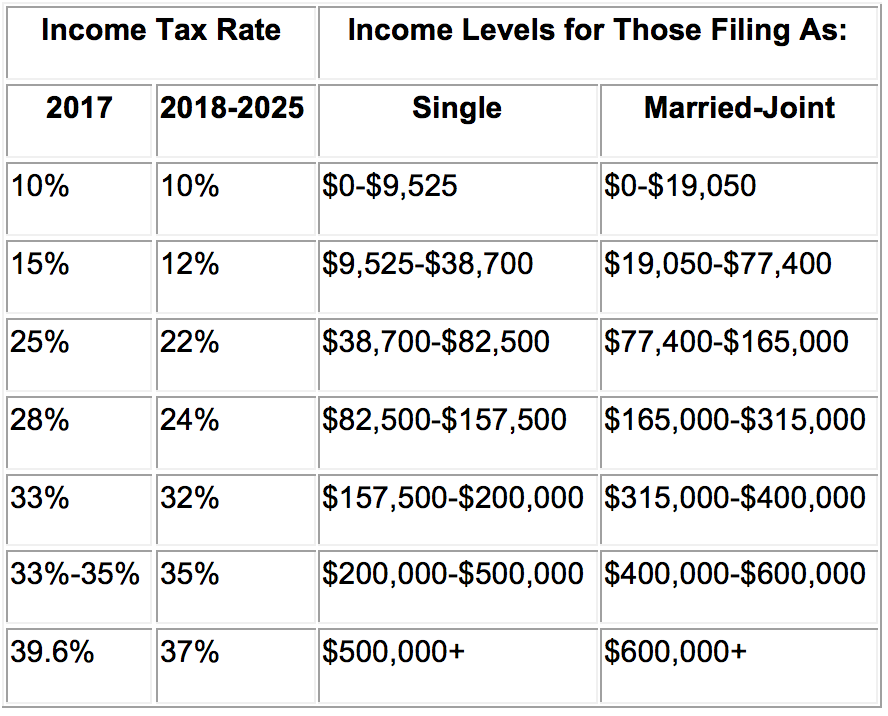

The Act retains the seven income tax brackets of the previous tax code, but with reduced tax rates for individuals in all brackets but one. Note: Capital gains rates remain unchanged under the new law.

Comparison of New Tax Rates vs. Old

Individual Deductions

• Standard deduction doubled from $6,350 for single filers to $12,000; married and joint filers increased from $12,700 to $24,000. This, coupled with the changes to itemized deductions, is likely to lead to more taxpayers taking a simplified approach to filing, i.e. electing the standard deduction.

Note: Traditionally, Virginia tax law has conformed to federal. However, that is not the case today as the state standard deduction has not been increased to track with the revised federal rules. There are proposals to revise the Commonwealth’s law, so be sure to check with your tax advisor to determine your best tax strategy.

• Mortgage interest deduction limited to the first $750,000 of the loan; permitted on first or second home; interest on loans up to $1 million initiated prior to December 15, 2017 grandfathered

• Home equity loan interest eliminated unless used to buy, build or substantially improve the taxpayer’s home that secures the loan.

• State and local income tax, sales tax and real property tax deductions limited to aggregate of$10,000

• Miscellaneous itemized deductions eliminated; includes employee business expenses and investment advisor fees

• Charitable contributions deductions are retained for those taxpayers able to itemize deductions

• Deduction for medical expenses increased to 7.5 percent or more of income in 2018; 10% in 2019.

• Alimony payments no longer deductible for new divorces beginning in 2019

• Casualty losses to personal property no longer deductible unless covered by specific federal disaster declarations

Individual Exemptions

• Personal exemptions of $4,150 eliminated

• Estate tax exemption doubled to $11.2 million for singles and $22.4 million for couples

• Alternative minimum tax exemption increased from $54,300 to $70,300 for singles; from $84,500 to $109,400 for joint filers

Individual Tax Credits

When compared to tax deductions, tax credits yield the better tax savings. Tax deductions reduce the amount of your income subject to tax. Tax credits directly reduce your tax bill.

• Child tax credit increased to $2,000 from $1,000

• American Opportunity Credit and Lifetime Learning Credit remain unchanged

• Credit of $500 for each non-child dependent.

• 529 savings plans permitted for tuition at private and religious K-12 schools Virginia’s Invest 529 is one of only four plans awarded by Morningstar its top rating, Gold.

General Tax Planning Strategies

• Defer taxable income from 2018 to 2019 if your effective income tax rate for 2019 will be lower than for 2018.

• Prepay deductible expenses this year using a credit card or check.

• Age 70½ or older … you may have your IRA trustee transfer up to $100,000 from your IRA directly to a qualified charity, and exclude the IRA transfer from income. The IRA transfer to the charity also counts toward the IRA owner's “Required Minimum Distributions" (RMDs) for the year.

• Maximize Retirement Plan Contributions to your IRA, 401(K) plan, etc.

• Check on your Flexible Spending Account plan’s deadline for withdrawals and your current account balance. To avoid losing funds, schedule your medical appointments and purchase other health care items covered by your plan.

• Check to be sure that your employer is withholding the correct amount of federal taxes from your paycheck. While not much time to adjust now, better to be aware of any shortfall now rather than next April. Use the IRS Withholding Calculator.

• Harvest stock losses that qualify as tax deductions. Whether you file singly or jointly you may deduct up to $3,000 in losses on stocks you sell before year-end. Doing so will reduce your taxable income, plus offset any gain on stocks you sell as well.

• Give up to $15,000 ($30,000 filing jointly) to unlimited number of people, free of gift or estate tax.

Business Owners

Under the new tax law, year-end tax planning for businesses include reduced tax rates for C corporations … lowered from 35 percent to 21 percent; elimination of the corporate alternative minimum tax; allowance for a 20% deduction for individual owners of certain proprietorships, partnerships and S corporations; and accelerated up-front write-off for an ever-expanding group of business assets.

The TCJA reforms can affect the bottom line of many small businesses. Notably, the tax-saving benefits come down to three major categories:

• Qualified Business Income Deduction

• 100% Expense Deduction for Depreciable Business Assets

• Employee Fringe Benefits

Qualified Business Income Deduction

This provision in the tax reform legislation applies to so-called pass-through businesses, i.e. enterprises’ income that is taxed on the firm-owners’ personal tax return. These entities include partners in partnerships, shareholders in S corporations, members of limited liability companies (LLCs) and sole proprietors.

All taxpayers who qualify as described above and who earn less than $157,500 and file singly ($315,000 for a married couple) can now deduct from their overall taxable income 20% of the income they receive via pass-through businesses.

There is more to the story, so be sure to seek guidance from a qualified tax professional.

100% Expense Deduction for Depreciable Business Assets

For tax years 2018 through 2025, businesses are now able to write off most depreciable business assets in the year the business places them in service. The 100-percent depreciation deduction generally applies to depreciable business assets with a recovery period of 20 years or less and certain other property.

Machinery, equipment, computers, appliances and furniture generally qualify. Additionally, the TCJA expands definition of eligible property improvements made to non-residential property.

Note: The maximum deduction increased from $500,000 to $1 million per year.

So if you’ve been holding off on these types of purchases, reconsider your position in light of the considerable tax savings that may result.

Employee Fringe Benefits

The predominant change in this category relates to deductions for entertainment and meals. The new law eliminates the deduction for expenses related to entertainment, amusement or recreation. However, taxpayers can continue to deduct 50 percent of the cost of business meals if the taxpayer or an employee of the taxpayer is present and other conditions are met. The meals may be provided to a current or potential business customer, client, consultant or similar business contact.

Takeaways

Note: This article is intended only as a summary of the new law’s highlights. The details are beyond the scope of this piece so seeking advice from a professional tax expert is advised as the tax code adjustments likely will affect your strategies to maximize benefits under the new law for you, your family and if applicable, your business.

Is the tax code complex? Yes … for both business owners and individual taxpayers. And this, the first taxable year under the revised tax code, stands to be even more complex as there are unanswered questions and interpretations that will continue to surface.

As ever, Blair + Assoc stands ready to help!

Give us a call or an email. We’ll respond promptly.

- OPPORTUNITY ZONES

- VIRGINIA TAX WINDFALL

- WILL THE IRS CHILL SALT

- YOU’RE FLATTERED … ASKED TO BE AN EXECUTOR OR TRUSTEE

- WHETHER YOU HAVE ONE OR NOT … YOU NEED TO KNOW

- THE SALES TAX TIMES ARE A’CHANGING

- S CORP OR C CORP?

- THE THINGS WE HEARD DURING TAX SEASON

- Q1 + 1

- SMALL BUSINESS AND THE 20% PASS-THROUGH