Questions Raised by the New Tax Law

June 2018

Well the Tax Cuts and Jobs Act (TCJA) has now been the law of the land for nearly half of 2018. As a result of the changes in tax law, a major consideration for many small business owners of pass–through entities is whether it would be beneficial to revoke their S corporation election.

This question is prompted by a change in the tax law that reduces C corporation taxes to a flat 21%. A quick reading of this significant tax reduction leads some owners of S corporations to consider converting to a C corporation as the tax rate appears more attractive than potential pass-through tax rates … ranging from 29.6% to as high as 37%.

However, converting may not be a wise move. There are significant differences in the status of each of these business entities that requires a comprehensive, comparative look at all the pieces to the taxation puzzle.

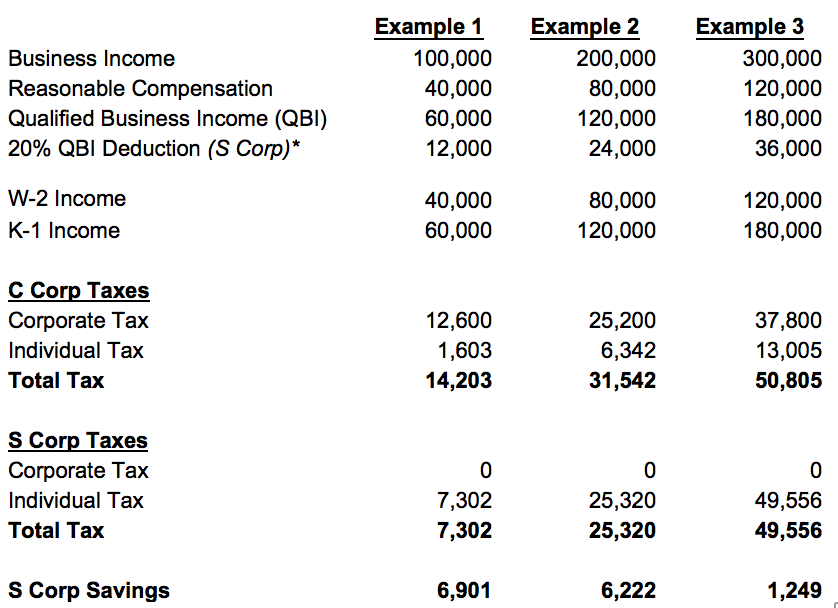

S corporations are considered pass-through entities under the TCJA. The good news for many small business owners is they may be eligible to deduct 20% of their qualified business income (QBI) beginning in tax year 2018. That means that qualifying pass-through entities will only be taxed on 80% of their pass-through income.*

A Comparison of ‘S’ vs. ‘C’

Here’s a comparison of the net effect of an S corporation vs. a C corporation under the same gross revenue scenarios.

Note: Owners of S Corporations must pay themselves “reasonable compensation”. The reason for this: The IRS does not want distributions to be in lieu of wages. Since S Corporations are not subject to self-employment tax, it would mean every dollar distributed as other than wages would avoid 15.3% in payroll taxes … potentially a major “hit” to revenue that supports Medicare and Social Security.

The net result under the new tax law is that “reasonable compensation” paid to the S Corporation taxpayer is excluded in computing qualified business income.

*Of course there are definitions, restrictions and limitations based on your taxable income and the industry in which you work. That said, if your taxable income is under $315,000 (filing jointly) or $157,500 (filing single) the limitations do not apply to you. Essentially, taxpayers who are below those thresholds may take the deduction no matter what business they are in.

However, keep in mind the deduction may be the lesser of 20 percent of your QBI or taxable income.

S corporation K-1 distributions are not subject to payroll taxes of 15.3%.

Eight Considerations Before Switching From ‘S’ to ’C’

• Potential for lower federal income taxes: Dependent upon amount of taxable income, the 21% flat C corporation rate may be more attractive than the net reduced pass-through rate of 29.6% which may be as high as 37% if taxable income exceeds thresholds.

• Double taxation of C corporations: C corporations are subject to two levels of federal taxes … at the corporate rate of 21% and again when distributed to shareholders. The combined effect may be as high as 39.8% which exceeds the highest potential pass-through rate of 37%.

• “Permanency” of corporate rate reduction subject to future changes to law.

• Expiration of individual tax rate reduction and the QBI deduction effective December 31, 2025.

• Changes to deductions: Under TCJA the deduction for individual state and local income taxes is severely limited, but remain fully deductible by a C corporation.

• State income tax: Corporate tax rates may be higher than the individual tax rates applicable to pass-through entities. In Virginia the corporate income tax rate of 6% may discourage Virginia pass-through entities to switch to C corporation status.

• Fringe benefits: Employer provided health insurance and cafeteria plans are limited for pass-through entities, but not restricted for C corporations.

• Exit and/or transition strategies may favor an S corporation if a future sale is anticipated.

Summary

Caution: As you can see, the decision to convert from an S corporation to a C corporation requires careful consideration. Analysis is likely to require extensive calculations and projections. Your business is unique and will have its own unique circumstances to deal with when considering such a change. Unfortunately, there is no easy answer to the question of whether or not a business should convert. The best advice is to talk to your tax advisors to determine which path is the best for your organization.

Planning is the No. 1 thing we're doing at Blair + Assoc for clients including doing a cost-benefit analysis when appropriate.

Just give us a call or drop an email. We’ll respond promptly!