TO ITEMIZE OR TAKE THE STANDARD DEDUCTION?

Under the New Tax Law…It Depends

August 2019

There have been loads of articles and newscasts that have underscored the sweeping changes that are now the law of the land under the new tax law. Of primary importance to most individual U.S. taxpayers is the significant change in both the standard deduction and itemized deductions as newly enacted, effective beginning with the 2018 tax year.

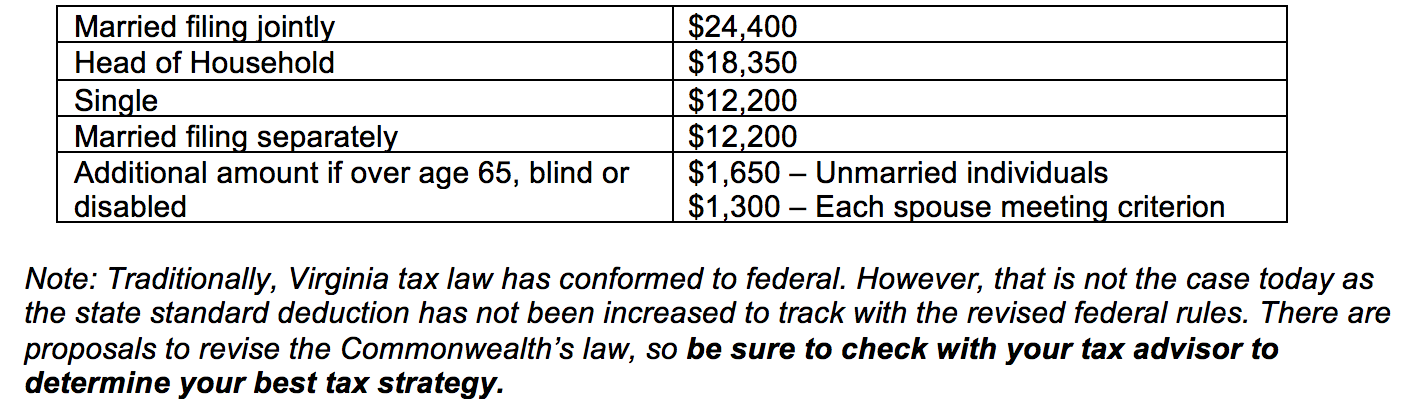

Notably, the standard deduction doubled from $6,350 for single filers to $12,000; married and joint filers increased from $12,700 to $24,000. This, coupled with the changes to itemized deductions, is likely to lead to more taxpayers taking a simplified approach to filing, i.e. electing the standard deduction.

While many taxpayers will choose the standard deduction for its attraction in being increased substantially as well as the simplicity of filing their returns. That said, it’s worth asking the question, “Which method saves you more money … standard or itemized?”

You can take either the standard deduction or itemized deductions on your tax return. You can’t do both. So, if your standard deduction is less than your itemized deductions, you probably should itemize. If your standard deduction is more than your itemized deductions, it might be worth it to take the standard deduction and save some time.

The most common expenses that qualify for itemized deductions include:

• Home mortgage interest

• Property, state, and local income taxes

• Investment interest expense

• Medical expenses

• Charitable contributions

• Miscellaneous deductions

As you can well imagine, there are limitations and definitions that apply to each of the above which will determine whether, or for how much, you may qualify if you choose to itemize deductions. The point is, it’s most often worth your time to compare the difference given your unique circumstances.

Your tax advisor can run your return both ways to see which method produces a lower tax bill. Even if you end up taking the standard deduction, at least you’ll know you’re coming out ahead.

We can help. Give Blair + Assoc a call or drop an email. We’ll respond immediately.

- LEVERAGING YOUR CHARITABLE CONTRIBUTIONS

- AGE 70½ … OR ABOUT TO BE … WITH AN IRA?

- OVER 70½ AND FEELING CHARITABLE

- PREDICTABLE SURPRISES THIS TAX SEASON

- THE 2019 IRS DIRTY DOZEN TAX SCAMS

- GIFTS FROM THE IRS??

- CONVERT LONG-TERM CAPITAL GAINS TO TAX SAVINGS

- BACK TO THE FUTURE

- WORDS HAVE MEANING

- GET READY TO GET READY FOR YOUR 2018 TAX FILING