PREDICTABLE SURPRISES THIS TAX SEASON

“I Owed Uncle Sam Taxes!” or “My Refund Shrunk!”

May 2019

If you are among those taxpayers who reacted negatively to one or another of the above related to your 2018 tax filing, you are not alone. Admittedly, there is little consolation in the adage, “misery likes company” … however there is a lesson learned regarding what you can do to head off a repeat performance next April when your 2019 return is due.

A Bit of History

The Tax Cuts and Jobs Act revisions affected taxpayers for the first time in 2018. While the seven income tax brackets of the previous tax code were retained, the result is a 3% to 4% cut in tax rates for individuals in all brackets but one. As a result, these reductions began to be enjoyed by employees as they realized reduced employer payroll withholding and larger take-home pay beginning with their February 2018 paychecks.

The IRS issued a revised withholding table that complied with the new tax law. Employers were instructed to begin using those numbers to determine withholdings from employee paychecks effective no later than February 15, 2019.

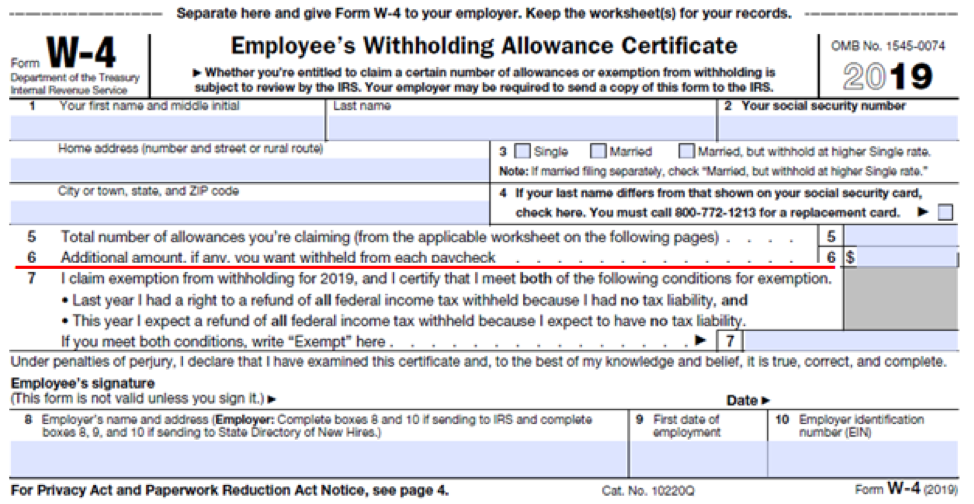

Here’s the potential for a “disconnect”. Your IRS W-4 form is the “source document” that determines how much is withheld from your paycheck. Your income, marital status, payday frequency and the number of withholding allowances you claim are all key elements.

That said, the only W-4 form available for tax year 2018 was based on 2017 tax laws and reflects deductions no longer available under the new tax law.

Bottom-line is that while your take-home pay may have increased, it may have also resulted in an unexpected higher tax surprise for 2018. The reason: The amount of withholding by your employer was not sufficient to satisfy the new tax code as it was calculated based on your prior year’s W-4 selection.

Here’s an Example: Assume that your W-4 monthly withholdings before the tax law changes was $1,000 … $12,000 over the course of the year. If your actual tax liability was less, say $11,000, you would receive a refund of $1,000.

Now, if under the new tax tables, only $900 was withheld monthly from your paycheck during 2018 and your tax liability remained at $11,000 … you would be responsible to stroke a check to Uncle Sam for $200.

By the way, in our example above, you as the taxpayer would have $100 more money in your pocket each month, but owe the tax man $200 at year end.

The Solution to Avoid Tax Surprises This Year – The Paycheck Checkup

Particularly if your circumstances are complex, consult with a tax professional to analyze the new table to make sure your withholdings are adequate to support a bigger paycheck now but not trigger a bigger tax bite at year end. This will give you what you need to revise your W-4 information to minimize or eliminate any negative impact on your tax liability.

If you prefer a DIY approach, look at your 2018 tax liability in excess of withholding and divide that amount by the number of pay periods left in 2019. The result of that arithmetic will show you the additional amount you should have withheld to avoid any unwanted tax-payable surprises when you file your 2019 return.

Then complete and submit your revised Form W-4 to your employer.

Important Note: See the reproduction of Form W-4 below. We strongly suggest that you not change the number of exemptions which some people are tempted to do on Line 7 of the W-4. That can lead to complications as that information is more susceptible to change during the year. The safer route is to stipulate the additional amount to be withheld on Line 6 calculated as described above.

Boost your tax withholding as early as possible in 2019 to head off another tax-time shock next year.

Taxpayers Who Are Most Affected

Our experience at Blair + Assoc this tax season revealed that the most affected taxpayers were married couples with dual incomes earning between $75,000 and $200,000 … especially if there were no children.

Additionally, taxpayers who had an important life change such as getting married or divorced, buying a home or having a baby should definitely proceed with a paycheck checkup. Here’s a bit more detail to alert taxpayers who should particularly pay close attention to their W-4 withholdings.

• W-2 employees with a “Side-Hustle”: Got a side-job? Chances are you aren’t withholding enough to cover both streams of income come tax time.

• Itemizers: If you were itemizing deductions prior to 2018, be sure to review your W-4. With the doubling of the standard deduction under the new tax law for both single and joint filers, you may have withdrawals based on your itemizing days that are less than you should consider today.

• Families with dependents: Again, there are changes to the new tax law that may affect your current withholding amount. Significantly, the new code broadened the applicability of the child tax credit that now will benefit higher-income households.

• Retirees: Check to see if your 2018 withholding was acceptable to you. If a change is in order, revise Form W-4V to adjust your Social Security check or Form W-4P for pension withdrawals.

Takeaways

You are not alone! Most people are affected by changes made in the Tax Cuts and Jobs Act. These changes included lowered tax rates, increased standard deductions, suspension of personal exemptions, the increased Child Tax Credit and limited or discontinued deductions.

You may be a taxpayer who fell into one or another of two categories of dissatisfaction … lower refund than expected or unanticipated additional tax liability. If so, know that the way to avoid a recurrence of either of these distasteful experiences is to do a paycheck checkup now and again every January. That way, if a withholding adjustment is necessary, there is more time to make up the deficit during the rest of the year.

Final note: If you are happy to have more cash flow during the year … and possibly face a higher tax bill at year-end or a smaller refund check … just know the dynamics of how the withholding machinery functions and how you are in control of its affect on your finances.

As ever, Blair + Assoc stands ready to help!

Give us a call or an email. We’ll respond promptly.

- THE 2019 IRS DIRTY DOZEN TAX SCAMS

- GIFTS FROM THE IRS??

- CONVERT LONG-TERM CAPITAL GAINS TO TAX SAVINGS

- BACK TO THE FUTURE

- WORDS HAVE MEANING

- GET READY TO GET READY FOR YOUR 2018 TAX FILING

- OPPORTUNITY ZONES

- VIRGINIA TAX WINDFALL

- WILL THE IRS CHILL SALT

- YOU’RE FLATTERED … ASKED TO BE AN EXECUTOR OR TRUSTEE