More Money for Your Favorite Charity … Lower Taxes for You

August 2019

You are probably aware from news accounts that the Tax Cuts and Jobs Act (TCJA) has doubled the standard deduction to $12,200 for single filers and $24,400 for married couples filing jointly. For many taxpayers who have usually itemized deductions this significant increase may alter their choice to take the standard deduction. That step concerns those who will then lose the tax benefit from the itemized deduction of charitable contributions.

Now, to itemize and receive a benefit for your charitable contributions, you need to have significantly more deductions (around double) before you receive a benefit.

That said, there may be some additional tax relief if you choose to make charitable contributions in the form of appreciated stock in an amount that may benefit you by itemizing deductions. Doing so delivers multiple benefits to both you and your favored charity. Under IRS rules, you may donate stock directly to a charity and not pay tax on any associated gains/increases in the value of the stock.

This is an attractive alternative to selling the stock for a gain, paying tax on the gain, and then donating the remaining cash proceeds to the charity. That means the donation you make and the deduction you get creates a win-win for you and your charity.

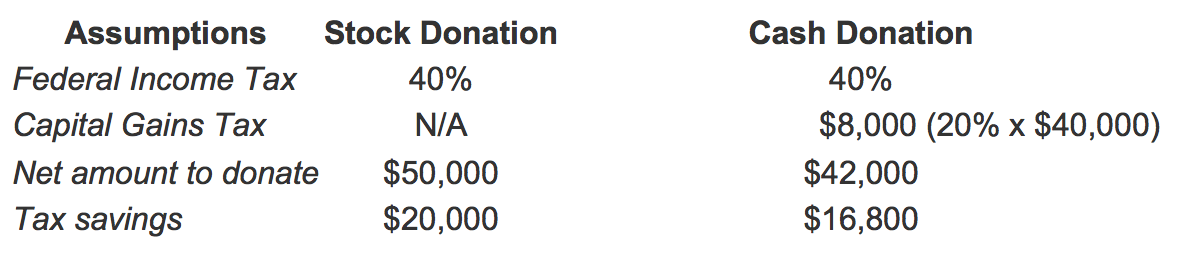

Here’s an example to drive this point home:

You have $50,000 in stock held more than one year with a cost basis of $10,000. Your choice is to either donate the stock to your charity or sell the stock and donate the after-tax proceeds. Let’s assume you have a 40% federal income tax rate and 20% capital gains rate.

Note: To obtain a deduction for the current tax year, the stock transfer must be completed by December 31.

When combined with other itemized deductions, your charitable contribution of appreciated stock may exceed your tax savings from a standard deduction … plus benefit the worthwhile cause you support.

Note: Not all charities are equal … when it comes to tax-deductible contributions. It’s critical that you determine whether your targeted charity qualifies as tax-exempt. Happily, the IRS has a resource that will help … the Tax Exempt Organization Search tool which allows you to search for charities and identify their tax status and filings.

If a charitable contribution of appreciated stock is something you’d like to consider, please keep in mind that we can help. Give Blair + Assoc a call or drop an email. We’ll respond immediately.

Note: State and local tax credits may affect federal charitable contribution deductions.

The IRS has issued final regulations that require taxpayers to reduce their charitable contribution deductions by the amount of state or local tax credits they receive in return. As a somewhat confusing but potentially beneficial additional comment, the service stated that taxpayers may treat payments they make in exchange for these credits as state or local tax payments … allowing taxpayers to deduct some, or all, of the payments as taxes.

Here’s a scenario if your state has a state tax credit program that grants a 70 percent state tax credit to you as a contributing taxpayer who itemizes on your federal tax return. Here’s how that may work out for you

Say you contribute $1,000 to your state tax credit program, and consequently receive a $700 state tax credit. As a taxpayer who itemizes your federal deductions, you must reduce the $1,000 federal charitable contribution deductions by the $700 state tax credit … leaving you with a net federal charitable contribution deduction of $300.

Remember, the above is a summary of the rules regarding state tax credits and the effect on federal charitable contribution deductions. As ever, there is more to the story including exceptions to the rules. Be sure to check with your tax professional to ensure an accurate assessment of your status under the new regulations.

We can help. Give Blair + Assoc a call or drop an email. We’ll respond immediately.