IRS TAX WITHHOLDING ESTIMATOR

November 2021

With all the distractions and turmoil triggered by the pandemic, it may seem surprising that the fourth quarter of 2021 is upon us … and that means limited time to do a “Paycheck Checkup” to make sure the right amount of tax is withheld from your earnings.

What to Do

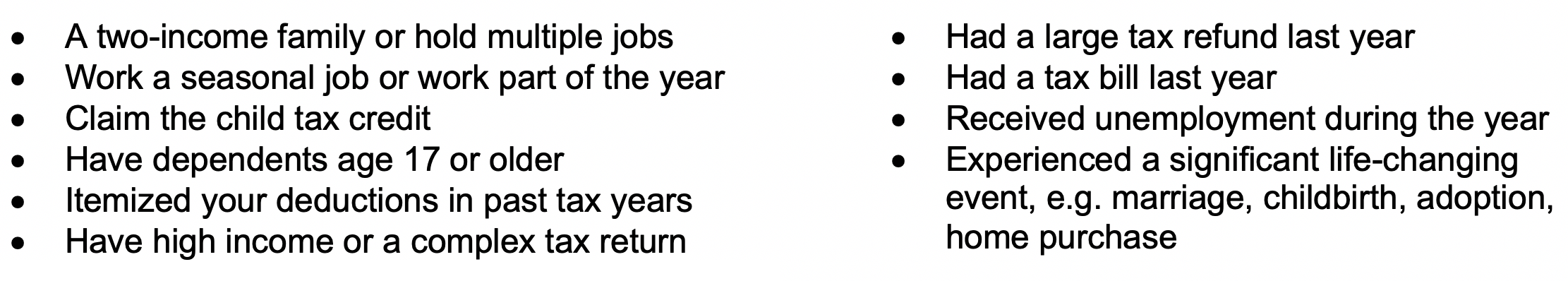

Your objective is to determine if there is a need to adjust your withholding. If that proves to be the case, your next step is to submit and new Form W-4, Employee’s Withholding Certificate to your employer. All taxpayers should check, but especially those who fit the following profiles.

A quick way to make sure you are having the right amount of tax taken out of your pay is to use the IRS Tax Withholding Estimator. It will help you to lessen year-end tax bills or more optimistically estimate a refund.

Important! If you have a substantial portion of income not subject to withholding, (e.g. the self-employed, investors, retirees, those with interest, dividends, capital gains, alimony, and rental income), you may need to pay quarterly installments of estimated tax.

Have Immediate Questions or Concerns?

Blair + Assoc stand ready to help as needed. A phone call or email is all it takes.

- THE LOWDOWN ON GIFT GIVING

- IRS TAX TREATMENT OF CRYPTO…CURRENCY OR ASSET?

- BUSINESS OWNERS…BORROWERS OF PPP LOANS ALERT!

- FLEXIBLE SAVINGS ACCOUNTS (FSAs)

- WHAT DOES THE POPULATION OF VIRGINIA HAVE TO DO WITH IRS LOGJAM?

- NEW & IMPROVED CHILD TAX CREDIT

- WHERE’S MY REFUND!

- Federal Tax Deadline Extension & The New Child Tax Credit

- PPP LOAN FORGIVENESS & VIRGINIA SMALL BUSINESSES

- EXTENDED FINANCIAL RELIEF FOR INDIVIDUALS & BUSINESSES!