Definition…Blockchain…Buying & Selling…Tax Compliance

September 2021

Let’s start with what this article is not about…a primer on crypto. We’ll start with a brief background to set the stage for the tax issues as currently phrased via IRS guidance. Then be sure to read on to learn the agency’s preferences for Congressional action.

What’s Crypto?

Crypto is alternatively referred to as cryptocurrencies or cryptoassets. Cryptocurrencies facilitate you to buy goods and services or trade them for profit … all transacted online. “Real” money, e.g. U.S. dollars, must be used to purchase cryptocurrency which can then be used as payment for purchases or retained for future trading and hoped-for profit.

The term cryptoasset refers to crypto being viewed as property by the IRS rather than cash. More on this distinction in a bit and its potential for tax implications.

What is Blockchain?

Cryptocurrencies work using a technology called blockchain. The technology allows a secure way for individuals to deal directly with each other … without a government, bank or other third-party intermediary. An important appeal of this technology is that it’s spread across many computers making it difficult to hack and impossible to alter stored data.

Cryptocurrency “miners” use their computer skills to solve complex mathematical problems to process the purchase and sale of a cryptocurrency. The solving process verifies data blocks and adding transaction records to a public record (ledger) known as a blockchain. The miner who first successfully completes a new block is rewarded with that cryptocurrency for their work.

Buying & Selling Cryptocurrency

Buying and selling transactions can be initiated between individuals or other entities directly. Additionally, buy/sell trades may be transacted via cryptocurrency trading exchanges as well as a growing number of online brokers.

For purposes of this piece, the key takeaway is that the trading of crypto is anonymous.

In the absence of reporting requirements, the IRS mainly relies on taxpayers’ willingness to comply.

IRS Angst … Severe Deficiency in Tax Compliance!

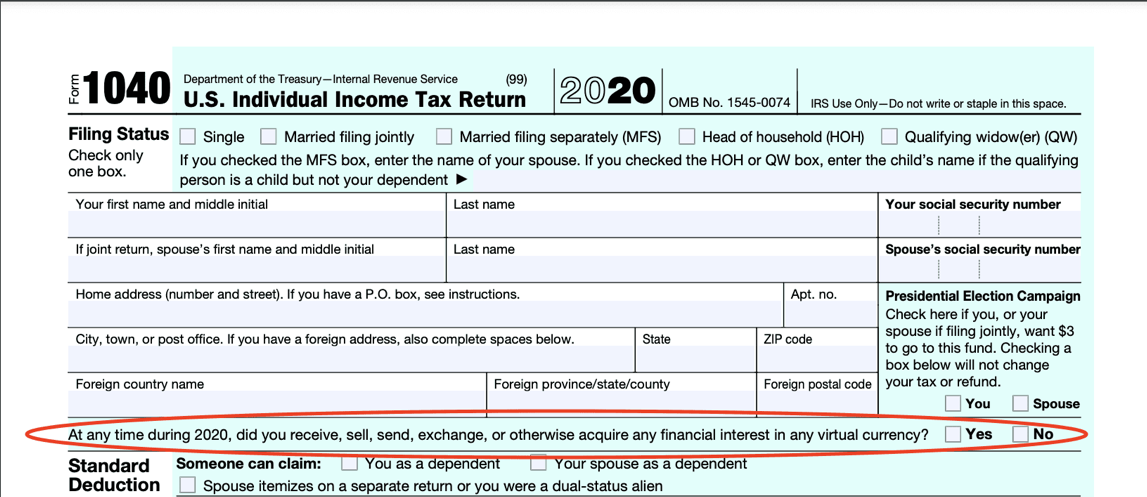

You need look no further than your Form 1040 to know that the IRS wants you to report crypto gains as evidenced by the following question: “At any time during (tax year), did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?” A simple ‘Yes’ or ‘No’ is the correct answer.

Crypto is considered property by the agency … the sale of which will produce either a gain or loss. That said, unlike traditional equity trades via brokerages, crypto exchanges are not subject to statutory requirements to issue year-end reports of taxable gains to both the investor and the IRS. For many crypto investors, this lack of reporting is a temptation to exclude gains on their tax returns.

The IRS preference is to include crypto-facilitating companies and exchanges in the infrastructure bill to report crypto-trading gains to the agency. Meanwhile, the IRS is going after exchanges via the courts to get names trades and activity of investors on those platforms.

Alert: The risks are growing that taxpayers will be caught for non-compliance.

IRS – Current Tax Guidance

In 2014 and again in 2018, the IRS provided tax guidance on crypto reporting standards. As noted above, cryptoassets are treated as property for federal tax purposes.

That means the sale or exchange of cryptoassets … including from one to another … will result in a gain or loss based on the difference between the fair market value received and the taxpayer’s cost basis. IRS guidance allows any reasonable method to calculate a cryptoasset’s value at a specific point in time.

Again, taxpayer willingness to comply is the primary driver of reporting gains to the IRS on the sale of cryptoassets. IRS chief Charles Rettig says the country is losing about a trillion dollars every year in unpaid taxes, and he credits this growing tax gap, at least in part, to the rise of the crypto market.

Clearly, the IRS is in the business of collecting revenue. To fund the aggressive pursuit of back-due taxes, the agency is seeking a budget-boost of $80 billion and new powers to crack down on tax dodgers … including those trading in crypto. The payoff to the Treasury is estimated at $5 for every $1 spent on enforcement activity … with many thinking that to be an understatement when it comes to crypto tax collection efforts.

Congressional Actions

In August of this year, the Senate passed a bill that will enhance the transparency of crypto trading with the addition of proposed IRS reporting requirements. The new reporting rules are included in the $1.2 trillion infrastructure spending bill, yet to be brought for consideration and vote by the House of Representatives. House Speaker Nancy Pelosi has said she’ll bring up the bill for a vote when President Joe Biden’s $3.5 trillion social spending and tax plan is also ready for consideration, which could be months from now.

The Treasury clarified that only cryptocurrency companies deemed to be brokers will need to comply if the proposed rules are enacted as written. Excluded from compliance are software developers and miners. This added scrutiny is estimated to raise $28 billion over 10 years from a current crypto market pegged at $2 trillion annually.

The new reporting rules, if signed into law, won’t go into effect until 2023, giving the government and cryptocurrency companies time to update their systems to send the data prescribed in the law. It also gives the industry time to ramp up lobbying efforts which may affect the ultimate outcome.

Takeaways

The IRS is likely to accelerate its aggressive pursuit of those crypto investors that exclude capital gains from crypto sales on their tax returns.

If you are a crypto investor or contemplating becoming one … please appropriately answer this question:

![]()

Be sure to maintain adequate records to substantiate sales or exchanges of cryptoassets.

Have Immediate Questions or Concerns!

Blair + Assoc stand ready to help as needed. A phone call or email is all it takes.