NEW & IMPROVED CHILD TAX CREDIT

Just a Month Away for Qualifying Families to Receive Checks

June 2021

The Internal Revenue Service is sending letters to over 36 million families regarding qualification for monthly Child Tax Credit payments set to be sent in July. This is an effort to offer relief to the many American households that have suffered financially due to the pandemic.

Your family may be one of them. If so, expect an initial letter from the agency outlining eligibility … followed by a second letter personalized with an estimate of your monthly payment.

Qualifying households will benefit from an expanded Child Tax Credit of up to $3,600 per child in 2021. In this article, we’ll identify how you may qualify for the new and improved Child Tax Credit as provided for in the $1.9 trillion-dollar American Rescue Plan … and for how much.

The IRS notes that most families won’t need to take any action to obtain the payments. More on that below in the Income Qualifications section of this piece.

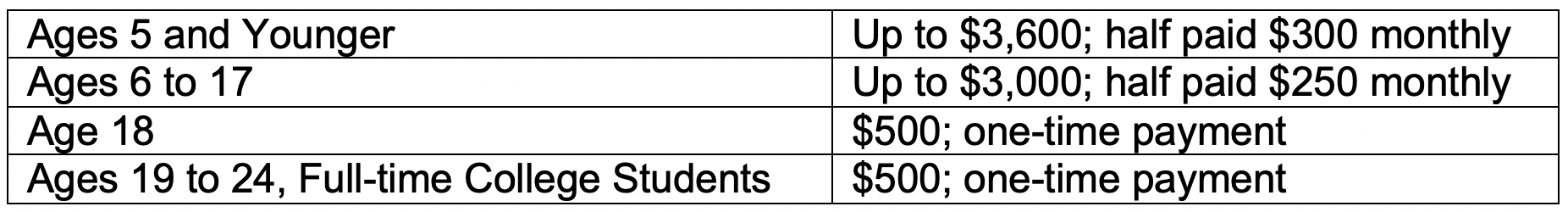

New, Increased Payouts

Of course, there are qualifying details, but before we go there here is a summary of the payouts for those eligible. The revised rules temporarily increase the child tax credit for the 2021 tax year. The bump is from the previous $2,000 limit to $3,000 per child age 6 to 17 … with an extra boost to $3,600 for children 5 years old and younger. For 18-year old dependents, the credit will be $500. Dependents ages 19 to 24 may qualify as well for the $500 credit if they are enrolled in college full-time.

Beginning July 15, qualifying households may begin receiving periodic payments of half the total credit amount. This is a departure from what would be the typical payout … a tax refund in 2022. But with the financial ravages induced by C-19, the intent is to get money into eligible taxpayers’ hands sooner as “advance payments”. The remaining half will be paid upon filing their 2021 tax return next year.

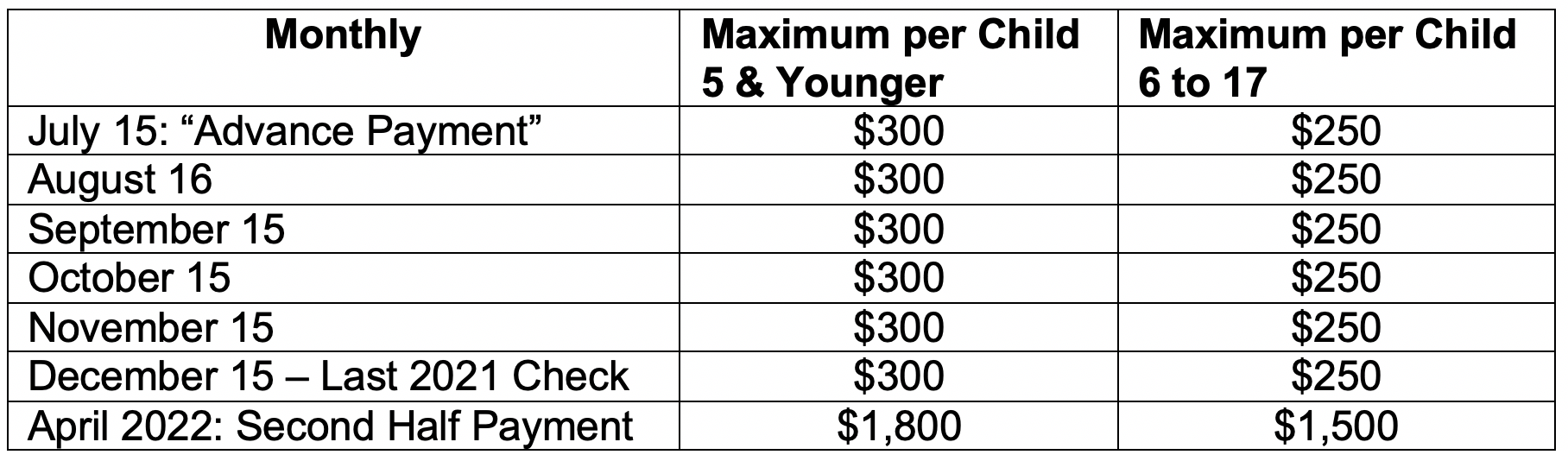

Payments will be sent for the months of July through December … $300 for each child under age 6 and $250 for each child ages 6 to 17. Most people will receive their money via direct deposit. The IRS will also mail checks or deposit funds to debit cards.

Here’s a breakdown of maximum payments.

Note: The amount of the credit is determined by the child’s age on December 31, 2021.

Newborns and U.S. citizen children adopted in 2021 may qualify for the credit.

As was the case with last year’s C-19 stimulus checks, the Child Tax Credit is based on the taxpayer’s adjusted gross income. To qualify for the remaining half-payment next year the following 2021 AGI amounts will apply:

• Single taxpayers - $75,000 or less;

• Head of household - $112,500 or less;

• Married filing jointly - $150,000 or less.

To accelerate financial relief to taxpayers, the IRS will review your 2020 income tax return to determine qualification. For those who have not yet filed for 2020, the IRS will accommodate by basing qualification on the 2019 return. In the event a taxpayer’s 2021 income exceeds the qualifying amounts, any excess credits will be refunded to the Treasury when filing their 2021 return.

Important! There is a phaseout provision. For every $1,000 a taxpayer earns over the AGI limit will reduce their credit by $50. That can be significant. For example, a single filer declaring an AGI of $85,000 will forfeit $500 per child.

Your Choice of When to Receive Payments

Beginning July 1, taxpayers may access two IRS portals to choose to receive checks monthly or opt for a single payment in 2022.

One portal will support people who don’t usually file an income tax return to provide information to receive payments.

The other of the two portals will provide families the facility to update their info if their circumstances have changed … and to choose monthly payments in 2021 or a lump sum next year.

IRS Commissioner Charles Rettig stated that, “We will launch (portals) by July 1 with the absolute best product we are able to put together.” So, stay alert for news of the new portal and stay abreast of your qualifications for the increased credit.

For those qualifying taxpayers that choose advance monthly payments, here’s what to expect.

Child Tax Credit Payments Timeline

Note: The amount of tax you owe when you file your 2021 tax return next year will be reduced by the credits you enjoyed this year … or increase your tax refund if applicable.

What If You Received Too Much?

When you file your 2021 tax return next year, you may find that you received more money than you were entitled to. The payment amount is based on an IRS estimate. Overpayments may result in a smaller tax refund next year or a larger tax bill.

And If You Don’t Qualify?

The new Act does not negate the Child Tax Credit provided for in 2017 under the Tax Cuts & Jobs Act. The existing Child Tax Credit is still available! Single taxpayers with an AGI of $200,000 or less or taxpayers filing married with an AGI of $400,000 or less will still qualify for a $2,000 tax credit for each child under age 17.

You’ll likely have questions regarding your specific circumstances, so be sure to give us a call or drop an email.

- WHERE’S MY REFUND!

- Federal Tax Deadline Extension & The New Child Tax Credit

- PPP LOAN FORGIVENESS & VIRGINIA SMALL BUSINESSES

- EXTENDED FINANCIAL RELIEF FOR INDIVIDUALS & BUSINESSES!

- PAYCHECK PROTECTION PROGRAM LOANS

- GET READY FOR TAX-TIME!

- WORKING FROM HOME…WRITE-OFFS DURING THE PANDEMIC?

- CORONAVIRUS…THE IRS…YOUR TAXES

- THE MORE THINGS CHANGE…THE MORE THEY CONTINUE TO CHANGE

- SHOW ME THE MONEY!