TAX CODE SUNSETS ON THE HORIZON

Tax Cuts & Jobs Act Provisions to Expire at End of 2025

December 2024

The Tax Cuts & Jobs Act reduced tax rates for most taxpayers.

If Congress allows the TCJA to expire as scheduled,

most individuals and many businesses will suffer tax increases in 2026.

Background

In 2017, Congress enacted the Tax Cuts and Jobs Act (TCJA). The intent was to stimulate economic growth by reducing tax burdens for individuals and businesses. That said, many of the changes were deemed temporary and will expire at the end of 2025 including:

• Tax cuts for individuals

• Increased standard deduction

• Several itemized deductions capped or eliminated

Unless Congress acts to renew or amend the Act, the sunset provision means the tax code will revert to its pre-2017 levels. Tax experts anticipate that such a reversal will result in more than $4 trillion in combined tax increases in 2026, for both businesses and tax hikes on 62% of U.S. households.

The newly elected Congress will dictate whether these provisions will sunset, renew or be changed.

Individual Tax Provisions

The following will Sunset December 31, 2025 and Revert to pre-TCJA Status…

…Unless Congress Acts to Extend or Amend.

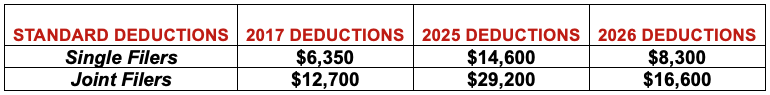

Standard Deduction

The TCJA more than doubled the standard deduction for both single and joint filers. The standard deduction will return to pre-TCJA levels, with an inflation adjustment.

Individual Income Tax Rates

Current top tax brackets under the TCJA are set to revert from 37% to 39.6%.

State and Local Tax (SALT) Deduction

TCJA rules capped the deductibility of state and local taxes at $10,000. Pre-TCJA all state and local property taxes were deductible.

Child Tax Credit (CTC)

The CTC was bumped to $2,000 for each child who is a citizen under age 17. The credit will revert to its former maximum of $1,000…reduced by 5 percent of adjusted gross income over $75,000 for single filers - $110,000 for those filing jointly.

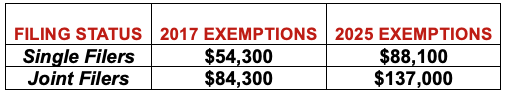

Alternative Minimum Tax (AMT)

The AMT exemption amounts were increased as were the income levels at which the exemptions phase out.

Income levels for the phase out of exemptions were substantially increased…in 2024 individuals at $609,350 and joint filers at $1,218,700.

The AMT exemption and exemption phase-out amounts will revert to lower pre-TCJA levels, adjusted for inflation.

Mortgage Interest

Mortgage interest deductions are limited by the TCJA to interest on loans not to exceed $750,000. Pre-TCJA limit - $1 million.

Estate Taxes

The estate and gift tax exemption will be reduced from $13.61 million per person (2024) to $7.2 million per person in 2026.

Business Tax Provisions – Permanent, Unless Congress Acts to Extend or Amend

Corporate Tax Rate

The corporate tax rate was slashed from 35% to 21% and remains permanent.

Research and Development (R&D)

The TCJA’s amortization requirement is permanent.

Business Tax Provisions to Sunset, Unless Congress Acts to Extend or Amend

Deduction for Small Business Income

Identified as section 199A, “pass-through businesses” enjoy a 20% deduction of qualified business income. Sole proprietorships, partnerships and S-corporations will lose this tax break.

Bonus Depreciation

The TCJA phased out the ability to immediately deduct 100% of the cost of qualifying property such as equipment and machinery. In 2025 the depreciation rate will be reduced to 50% and totally phased out by 2027.

Interest Deduction Limitation

Net interest deductions are limited to 30% of adjusted taxable income under TCJA provisions. Pre-TCJA caps are higher.

Limits on Net Operating Loss Deductions

The TCJA limited businesses' ability to carry back net operating losses to offset income from previous years and restricted offsets to taxable income in future years.

Takeaways

The above changes have the potential to create big shifts in how much individuals and businesses owe in taxes after December 31, 2025. The newly elected Congress will dictate whether these provisions will sunset, renew or be changed. We’ll keep you notified as lawmakers proceed.

The above presentation is meant as an overview only.

Give us a call and we’ll quickly help you with questions.

- NEW 1099K REPORTING THRESHOLDS

- VIRGINIA BUSINESS OWNERS & MANAGERS

- SMALL BUSINESS OWNERS

- VIRGINIA TAX BREAKS

- WHO KNEW? FOREIGN INCOME SUBJECT TO U.S. TAX REPORTING

- VIRGINIA 529 PLANS UNUSED FUNDS FREED UP FOR RETIREMENT

- TAX SEASON 2024…IN RETROSPECT

- TAX SCOFFLAWS…ARE NOW IRS COMPLIANCE TARGETS

- WAGER IF YOU WILL…WIN OR LOSE…2 GUIDING PRINCIPLES

- ELECTRIC VEHICLE (EV) PURCHASE ON YOUR 2024 WISH LIST?