TAXES 2025 - CONFUSION, WISHFUL THINKING, WHAT’S REAL & WHEN?

Lots of Conversation, Speculation, Misinterpretation

February 2025

As a frame of reference, the following is current as of this writing. We’ll stay tuned to actual happenings as they occur and pass on the latest to you as reality unfolds. Bottom line at the moment…there are many proposals, recommendations and conflicting support for tax revisions, here are a prominent few to review.

Social Security

The short answer is: No changes from tax year 2024.

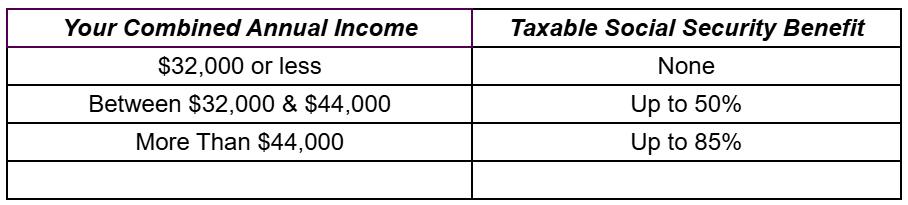

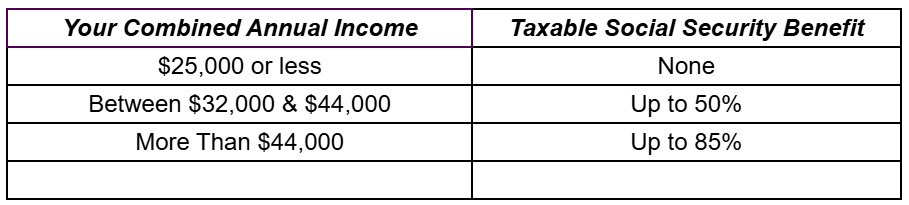

Your Social Security retirement income may be taxed based on the Social Security Administration (SSA) determination of your “combined” income.” That number is the sum of your adjusted gross income, plus any non-taxable interest and half of your Social Security income. Take a look at the following matrix to see when/if your benefits will be taxable.

Social Security Federal Income Tax

Married Filing Jointly

Individual

Tips

President Trump renewed his call to eliminate federal taxes on income received as tips. There is much discussion among lawmakers about various approaches to initiating this tax revision. To date, nothing has been finalized. As the debate continues…

The IRS is specific: Tips are taxable. All cash and non-cash tips received by an employee are income and are subject to Federal income taxes. All cash tips received by an employee in any calendar month are subject to Social Security and Medicare taxes and must be reported to the employer.

Child Tax Credit

The tax credit remains unchanged…$2,000 per qualifying child. Under the Tax Cuts and Jobs Act of 2017 (TCJA), the maximum child tax credit was increased to $2,000 from $1,000 for each child under the age of 17. Additionally, taxpayer eligibility was expanded with higher income phaseouts.

That said, unless Congress acts otherwise, the elevated benefit will revert after tax year 2025 to the child tax credit provisions in effect prior to the TCJA.

EV Credits for Electric Vehicles

There is no change in the tax credit…up to $7,500 per vehicle through 2032. There is much discussion about banning the credit, but nothing has come of it to date. Click here for the most up-to-date information on which vehicles qualify for the tax credit.

Itemized Deductions

There is no limitation on itemized deductions in 2025. The limitation on itemized deductions was eliminated by the Tax Cuts and Jobs Act of 2017. While there has been consideration to eliminate medical, taxes, interest and charity deductions it does not appear that there is any meaningful forward motion to initiate revisions to the current tax code.

State and Local Tax (SALT)

The IRS clearly limits the SALT deduction in 2025 to $10,000 for joint filers and $5,000 if married filing separately. The deduction is scheduled to expire at the end of this year unless Congress acts to extend or revise the cap.

Note: Click here for more information on the tax provisions scheduled to expire this year.

The above presentation is meant as an overview only.

Give us a call and we’ll quickly help you with questions.

- SIGNIFICANT DROP IN THE POOL OF ACCOUNTANTS

- TAX CODE SUNSETS ON THE HORIZON

- NEW 1099K REPORTING THRESHOLDS

- VIRGINIA BUSINESS OWNERS & MANAGERS

- SMALL BUSINESS OWNERS

- VIRGINIA TAX BREAKS

- WHO KNEW? FOREIGN INCOME SUBJECT TO U.S. TAX REPORTING

- VIRGINIA 529 PLANS UNUSED FUNDS FREED UP FOR RETIREMENT

- TAX SEASON 2024…IN RETROSPECT

- TAX SCOFFLAWS…ARE NOW IRS COMPLIANCE TARGETS