WHAT DOES IRMAA HAVE TO DO WITH YOUR MEDICARE PREMIUMS IN 2024?

Medicare Recipients with Income Above the Threshold

Must Pay a Surcharge Based on Their Income

November 2023

Medicare open enrollment is now underway through December 7. If you have Medicare Part B and/or Part D prescription drug coverage, you may be subject to a monthly surcharge based on IRMAA…an income related monthly adjustment amount. Here are some details you need to know.

Based on IRMAA, Medicare participants with higher incomes pay more for Part B and D premiums.

Those additional charges have increased for 2024. By way of contrast, in 2023 a single person with income between $97,000 and $123,000 paid $230.80 each month, compared to premiums of $164.90 for people who earned less. Those numbers are bumped in 2024 to $69.90 monthly for single filers who make between $103,000 and $129,000…for a total of $244.60.

Your income for IRMAA purposes is calculated based on your earnings two years before the plan year. Whether you pay an IRMAA surcharge in 2024 depends on your 2022 tax returns.

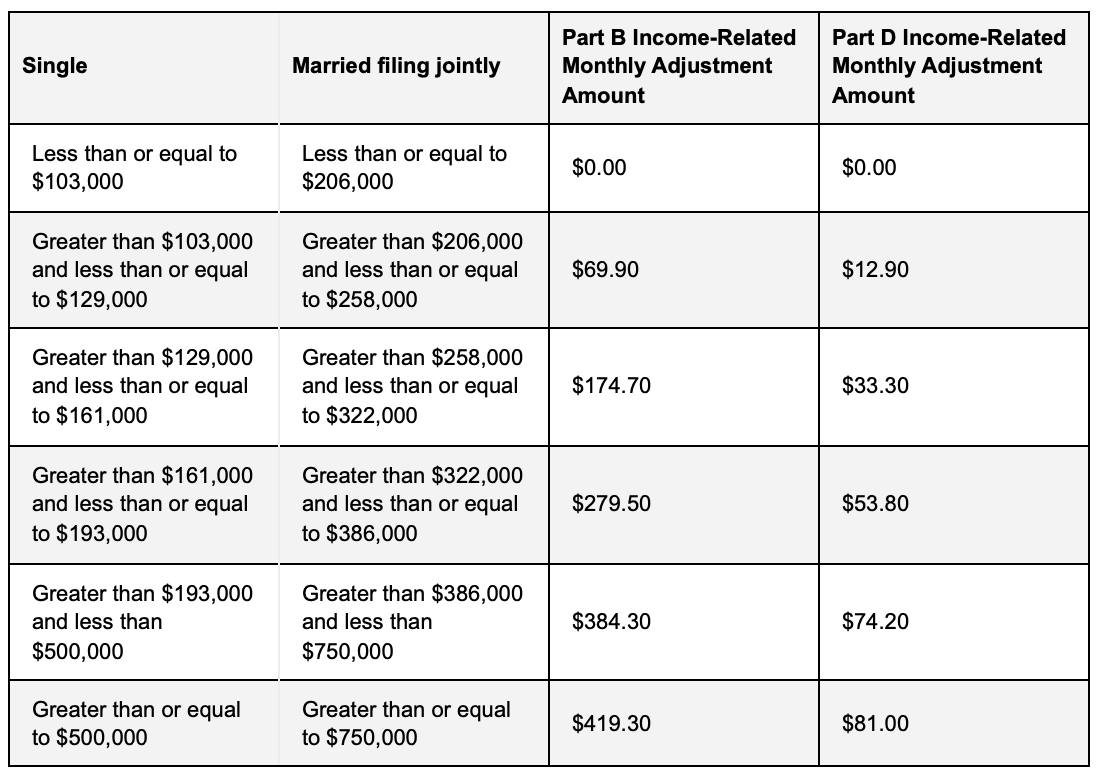

IRMAA charges change annually with inflation. Calculations are on a sliding scale with six income brackets topping out at $500,000 and $750,000 individual and joint filing, respectively.

The following chart illustrates how income thresholds determine Parts B & D IRMAA surcharges.

IRMAA for 2024

You can appeal your IRMAA surcharge if your income is significantly lower now than two years ago due to a life-changing event such as retirement, divorce or death of a spouse. In the absence of life-changing events, your next line of defense is to work with your tax advisor to see if you can lower your modified adjusted gross income (MAGI).

Click here for more detail … or better yet, give us a call.

- SOCIAL SECURITY RECIPIENTS GET A “RAISE”

- MORE GOOD NEWS… RETIREMENT PLANNING 2024

- WHAT DOES PORTABILITY HAVE TO DO WITH YOUR ESTATE PLAN?

- IRS HALTS PROCESSING ERC CLAIMS

- VIRGINIA TAXPAYERS TO ENJOY MORE THAN $1 BILLION IN TAX RELIEF

- AMERICAN TAXPAYERS WHO OWN THEIR HOME

- WAGE INFLATION & BRACKET CREEP

- BUSINESS OWNERS & MANAGERS: EMPLOYEE RETENTION CREDIT

- Comprehensive Taxpayer Attitude Survey (CTAS) 2021

- SECURE 2.0 ACT…AND YOUR RETIREMENT