Mileage Rates Increased & Meal Deductions Extended

July 2022

The Internal Revenue Service has announced two tax savings benefits … an increase in the allowable mileage rate deduction and the extension of the 100% deduction for the cost of business-related food and beverages purchased from a restaurant.

Mileage Rate Increased

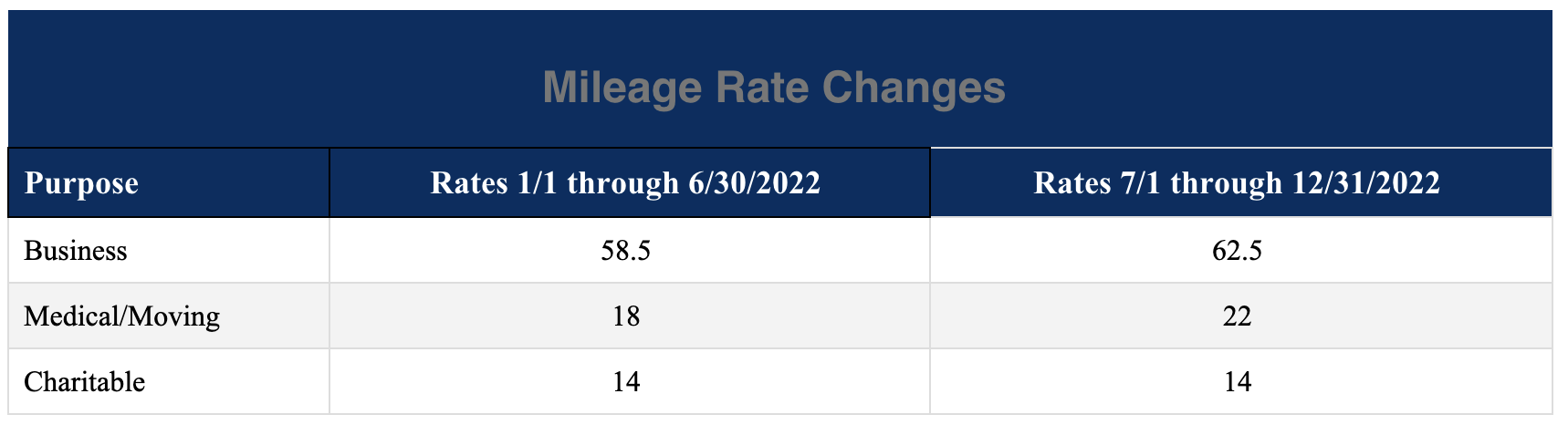

Effective July 1, the standard mileage rate for the final 6 months of 2022 has been increased by 4 cents per mile to 62.5 cents per mile. Likewise, the new rate for deductible medical or moving expenses (available for active-duty members of the military) is increased by 4 cents to 22 cents for the remainder of this year.

"The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices," said IRS Commissioner Chuck Rettig. "We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.” Additionally, other items comprise the calculation of mileage rates as well ... such as depreciation, insurance and various fixed and variable costs.

Midyear increases in the optional mileage rates are rare, the last time the IRS made such an increase was in 2011.

Note: For travel from January 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03PDF.

See the chart below for a quick reference to the increases described above.

Enhanced Business Meal Deduction – Here's What Businesses Need to Know

Beginning in 2021, businesses are permitted to deduct the full cost of business-related food and beverages purchased from a restaurant. That enhanced deduction is continued for tax year 2022 … a sizable increase in tax savings from the usual limit - 50% of the cost of qualifying meals.

Here are the qualification requirements to benefit from the enhanced deduction:

- The business owner or an employee of the business must be present when food or beverages are provided.

- Meals must be from restaurants, which includes businesses that prepare and sell food or beverages to retail customers for immediate on-premises or off-premises consumption.

- The cost of the meal can include taxes and tips.

- The cost of transportation to and from the meal isn’t part of the cost of a business meal.

- Payment or billing for the food and beverages occurs after December 31, 2020, and before January 1, 2023.

- The expense cannot be lavish or extravagant. An expense isn't considered lavish or extravagant if it is reasonable based on the facts and circumstances. Meal expenses won't be disallowed merely because they are more than a fixed dollar amount or because the meals take place at deluxe restaurants, hotels, or resorts.

Note: Grocery stores, convenience stores and other businesses that mostly sell pre-packaged goods not for immediate consumption, do not qualify as restaurants. The same holds true for employer-operated eating facilities, even if they operate under contract by a third party.

Business owners may be able to deduct the costs of meals and beverages provided during an entertainment event if either of these apply:

- the purchase of the food and beverages occurs separately from the entertainment

- the cost of the food and beverages is separate from the cost of the entertainment on one or more bills, invoices, or receipts.

If any of the foregoing seems unclear as to how it applies to your specific circumstances,

please keep in mind that Blair + Assoc will help. Give us a call or drop an email.