Here’s a Heads-up to Get Set for Your Meeting with Your Tax Advisor

December 2019

Last tax year, 2018, marked the end of the first tax year under the Tax Cuts and Jobs Act (TCJA). The good news was that most taxpayers, both businesses and individuals, enjoyed tax savings under the new regulations. As we complete the second year under the new code there are a few changes to be aware of that will help with your planning to maximize your benefits and minimize your tax bite.

So, the following is intended to provide you with information to have a meaningful meeting with your tax advisor as you file your 2019 return. We’ll take a look at the tax rates, tax deductions and exemptions provided for in the revised tax code, TCJA, for both individuals and businesses.

Individual Taxpayers

Note: Most individual changes are effective January 1, 2018 and will expire at the end of 2025.

Unless Congress passes another law prior to then, the old tax code provisions will be reinstated.

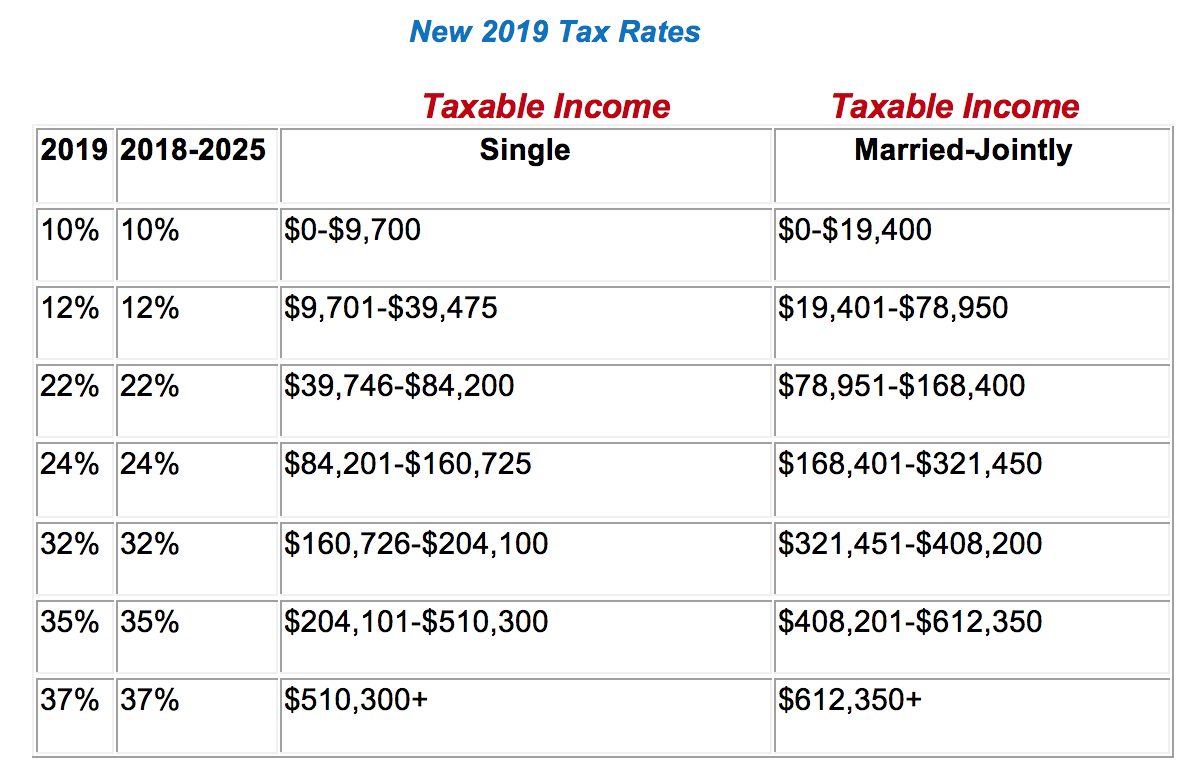

The 2019 tax rates duplicate those of tax year 2018. However, as is the case every year, the 2019 tax bracket ranges are updated, or indexed, for inflation. Take a look at the table below to see how the new tax brackets may affect your tax circumstances. Note: Capital gains rates remain unchanged under the new law.

As a reminder, among the new tax code of 2017 changes affecting individual taxpayers include doubling the standard deduction, elimination of personal exemptions, and numerous itemized deductions reduced or eliminated.

Individual Income Taxes

Individual Deductions

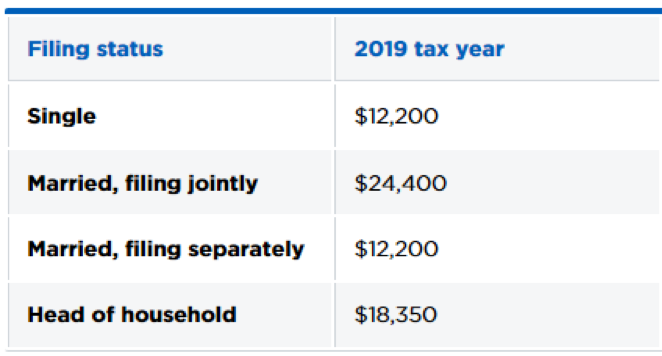

• Standard deduction increased from $12,000 for single filers to $12,200; married and joint filers increased from $24,000 to $24,400. This, coupled with the changes to itemized deductions, is likely to lead to more taxpayers taking a simplified approach to filing, i.e. electing the standard deduction.

Here are the standard deduction amounts by filing status:

The standard deduction is $1,300 higher for those who are over 65 or blind;

it’s $1,650 higher if also unmarried and not a surviving spouse.

• Mortgage interest deduction limited to the first $750,000 of the loan; permitted on first or second home; interest on loans up to $1 million initiated prior to December 15, 2017 grandfathered

• Home equity loan interest eliminated unless used to buy, build or substantially improve the taxpayer’s home that secures the loan.

• State and local income tax, sales tax and real property tax deductions limited to aggregate of $10,000

• Miscellaneous itemized deductions eliminated; includes employee business expenses and investment advisor fees

• Charitable contributions deductions are retained for those taxpayers able to itemize deductions

• Deduction for medical expenses increased to 10 percent in 2019.

• Alimony payments no longer deductible for new divorces beginning in 2019

• Casualty losses to personal property no longer deductible unless covered by specific federal disaster declarations

Individual Exemptions

• Personal exemptions of $4,150 eliminated

• Estate tax exemption doubled to $11.2 million for singles and $22.4 million for couples

• Alternative minimum tax exemption increased from $70,300 to $71,700 for singles; from $109,400 to $111,700 for joint filers.

Small Business Section 199A Deductions

There was good news for many small business owners when the TCJA became the new tax law of the land. Of particular benefit, the Act carves out a brand-new tax deduction for owners of pass-through entities including partners in partnerships, shareholders in S corporations, members of limited liability companies (LLCs) and sole proprietors.

As a quick summary … beginning in tax year 2018, many small business owners became eligible to deduct 20% of their “qualified business income” (QBI). Said another way, qualifying pass-through entities will only be taxed on 80% of their pass-through income. As ever, there are limitations based on your taxable income and the industry in which you work. Additionally, there are new terms that you need to become familiar with. What follows are the three most significant definitions and restrictions.

Note: If your 2019 taxable income is under $321,400 (filing jointly) or $160,700 (filing single) the following limitations do not apply to you. These increases in income limitations contrast to those of 2018 … $315,000 and $157,500 respectively. Taxpayers who are below those thresholds may take the deduction no matter what business they are in.

Definitions & Restrictions

QBI: Qualified business income (QBI) is the net income from your business not including compensation and investment income received by you from your pass-through entity.

Specified Service Businesses: The TCJA specifically includes businesses in this definition as those where the principal asset of the business is the reputation or skill of 1 or more of its employees.

Wage and Capital Limit: There is a “phase-in” provision in the new law whereby the 20% deduction may be reduced, pro-rata, or eliminated based on taxable income that exceeds thresholds as indicated in the new regulations.

Rental Property Owners/Landlords

Now that we are in the last month of tax year 2019, rental property owners should exercise a sense of urgency to look at last minute actions you may take to fully realize the benefits of the new tax law. Here are two items to review with your tax advisor to determine how either or both may apply to your unique situation.

1. Section 179 Deductions, and

2. 100% Bonus Depreciation

Section 179 Deductions

Now, residential rental owners are permitted to deduct in one year the cost of depreciable personal property used in the rental business. Personal property includes furniture and appliances and perhaps, carpeting and flooring plus other equipment used in the living quarters of a lodging venue.

For tax year 2019 the maximum annual deduction is $1 million, essentially double the previous cap of $510,000. That’s in contrast to amortizing eligible expenses over several years … as was the case prior to enactment of the new tax code.

Bonus Depreciation

Bonus depreciation is now available on both new and used property. That means businesses may write-off the full cost of most depreciable property in the first year they use it in their business. For real estate investors, this means that many of the small home improvement projects completed each time a new tenant moves into a property can be written off on their yearly taxes … and enjoy reductions in their tax bite.

That said, to benefit from these tax breaks in 2019, you must incur the expenses prior to the end of this year. So, if you think you may qualify, see your tax advisor asap and make plans to move forward no later than December 31, 2019.

Rental Property Owners/Landlords Section 199A Deductions

As discussed above, the new tax law permits a tax deduction of up to 20 percent of Qualified Business Income (QBI), with some limits and exceptions. It appeared that most rental activity qualifies, for tax purposes, as a business. This means landlords may deduct 20% of net rental income over and above all other rental-related deductions. Net result … only 80% of rental income will be taxed.

Welcomed final QBI deduction regulations for real estate investors were clarified by the IRS. IRS Notice 2019-07 details the safe harbor for certain real estate enterprises to claim the deduction. Here’s a rundown of the key provisions for an eligible rental business to claim the deduction.

• Each rental enterprise must maintain separate books and records of income and expenses.

• At least 250 hours of rental services must be performed for the enterprise through 2022.

• Beginning with tax year 2019, the tax payer must maintain records of income, expenses, hours and description of dates services performed and by whom.

The QBI deduction is just one of several potential perks for real estate investors allowed under the new tax law. There are additional clarifications that are best discussed with guidance from your tax advisor as the qualifications can be somewhat complex depending on the specifics of your circumstances.

Next Step

As ever, Blair + Assoc stands ready to help!

Give us a call or an email. We’ll respond promptly.