Dealing With The Aftershock

June 2016

YIKES … you just received a 9X12 inch envelope – return address, IRS.

You slit open the packet and the first words you see are …

CP2000 Notice of Proposed Adjustments for Underpayment/Overpayment

The income and/or payment information we have on file doesn’t match the information you reported on your tax return. This could affect your tax return; it may cause an increase or decrease in your tax, or may not change it at all.

What are you going to do? Certainly, take it seriously, don’t ignore it, read it thoroughly and then choose one of two options to respond.

1. Let us help. We’ve taken care of these situations many, many times, have experience with the process, and how to best respond. That means less stress for you and a likely accelerated resolution to the IRS request.

2. DIY – How difficult can it be to deal with the IRS? (Sorry, vain attempt at humor)

Regardless of your choice, don’t panic. The letter does not automatically mean your return is wrong. So far all that has happened is that you are the target of an IT function called The Automated Underreporter (AUR). It sends out a Notice CP-2000 if the software picks up income reported by a payer (e.g. via W-2 or 1099 forms) that you did not report to the IRS. Alternatively, the computer will generate your deficiency notice if it appears that payments, credits and/or deductions are overstated.

The CP2000 is not a bill. It is deemed a “proposal” by the IRS to adjust your return to reflect any discrepancies described in the preceding paragraph. Your final result may be additional tax owed or a refund of taxes paid.

The CP2000 notification is a very common event and the number of notices continues to rise as the IRS works to close gaps in tax revenue. Additionally, advances in computer technology results in increased accuracy to identify inconsistencies in reporting. It is an initial request from the IRS for additional information or clarification of one of your past tax returns …and must be dealt with promptly.

So if you chose the DIY route, or are just curious about the process, here are the critical elements as outlined by the Internal Revenue Service. Italics are from Blair + Assoc.

What you need to do:

• Read your notice carefully—it explains the information we received and how it affects your tax return.

Read it twice. The IRS may well be correct, especially if you filed the return in question early in the year to hasten receipt of a refund. You may have inadvertently left off another source of income (e.g. 1099 Misc, IRA withdrawal or brokerage account 1099)..

• Complete the notice response form whether or not you agree or disagree with the notice. The response form explains what actions to take. (Your specific notice may not have a response form. In that case, the notice will have instructions on what to do).

Respond to the notice immediately. Your IRS “window” is 30 days from the date of the letter, not the date you received it. Make sure it is delivered to the IRS within the 30 day period. Failure to do so may result in additional penalties and interest. Use Certified Mail, return receipt requested.

If you have a disagreement, make sure you produce an iron-clad response to avoid the process getting bogged down in bureaucratic red tape. While the deficiency notice is computer generated, your response will be reviewed by live Agents.

• Contact the business or person reporting the information, if it is wrong. Ask them to correct it, and then provide the corrected information to us.

Do this with a request that the reporting entity attend to your request with a sense of urgency. Time is of the essence to resolve your issue with the IRS.

You may want to…

• Make sure your other returns don’t have the same mistake.

• Contact us with any unanswered questions you have.

• Keep a copy of the notice for your files.

• Fill out section 3 (Authorization) on the response form to allow someone, in addition to yourself, to contact us concerning this notice. Or send us a Form 2848, Power of Attorney and Declaration of Representative to allow someone (such as an accountant) to contact us on your behalf.

• Correct the copy of your tax return that you kept for your records.

• Order a transcript of your return.

• Use this link to learn more about your payment options if you owe additional taxes.

• Use this link to learn more about payment plans and installment agreements if you can’t pay the full amount of taxes you owe.

• Use this link to learn more about Offers in Compromise if you can’t pay the full amount of taxes you owe.

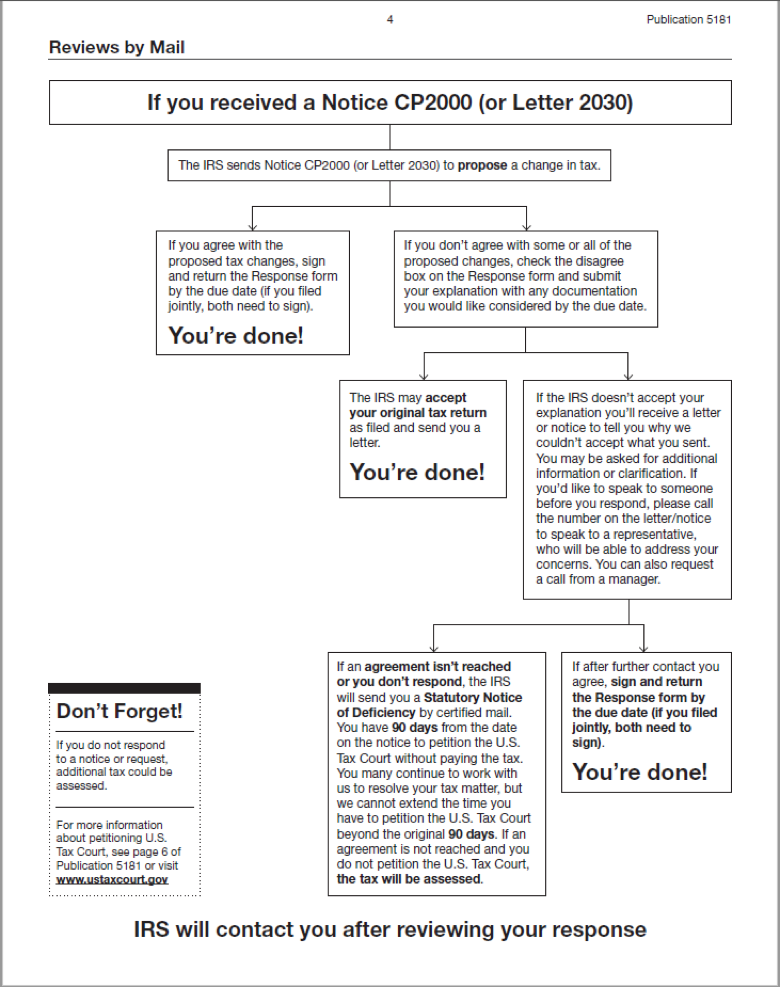

Here’s the IRS schematic that tells much (not all) of the story in graphic form.

Click Here for a more complete understanding of your CP2000 letter as well as frequently asked questions.

If you are a “do-it-your-selfer” and get stymied by any portion of the process, please keep in mind that we can help. Give us a call or drop an email. We’ll respond immediately.