May 2016

There are a number of good reasons for you to at least consider creating a trust. The benefits of a well-crafted trust may include minimizing estate taxes and avoiding probate. We’ll come back to these in a moment, but first some specifics about trusts.

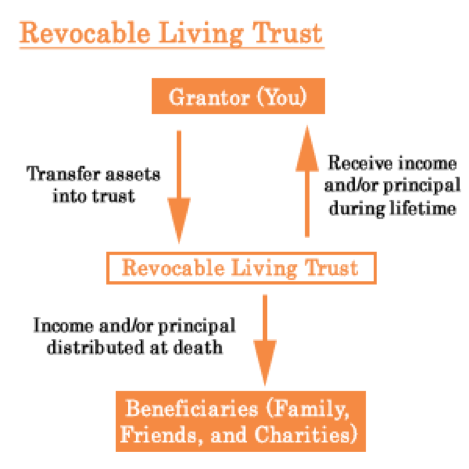

As a general definition, a trust is a fiduciary arrangement under which one person or entity, called a trustee, holds legal title to property for a beneficiary or beneficiaries. Broadly speaking, trusts may be categorized as either “revocable” or “irrevocable.”

Revocable Trusts

A revocable trust (also called a “living” trust or “inter vivos” trust) is one that you create while you are alive as opposed to one that is effective upon your death. You retain control of all trust assets during your lifetime. As the word “revocable” implies, you may rescind or revise any and all provisions of the trust during your lifetime. At death, a revocable trust reverts to being irrevocable and all terms are deemed permanent.

You may name yourself as trustee, or co-trustee. If you choose to do so, you will want to appoint a successor trustee to manage the terms of the trust in the event of your incapacity to carry out those duties or at your death.

Depending on how a living trust is structured, you may enjoy avoiding probate as well as provide for long-term management of trust assets.

Avoiding probate has three important elements … speed, privacy and savings.

On the matter of speed, the trust does not have to pass through probate court. That means the usual months of probate is by-passed thus hastening execution of the trust provisions and distribution of assets to the beneficiaries. Your successor trustee will transfer trust assets to beneficiaries as you directed via the trust … a matter of days or weeks, not months.

Probate proceedings are a matter of public record. A living trust will provide for disposition of trust assets while maintaining privacy of the details and named beneficiaries.

Often a concern is that beneficiaries of your estate may lack financial management skills or discipline. The trust may provide for how and when distributions are made and managed tailored to your assessment of the beneficiary’s needs

Finally, probate can greatly diminish the value of an estate. Lawyer fees and court costs may take a significant bite out of assets subject to probate.

While a revocable trust may help avoid probate, trust assets are usually still subject to estate taxes. The reason is that during your lifetime, it is treated like any other asset you own.

Note: As of the date of this writing, estates worth more than $5.45 million are subject to federal estate tax and will escalate based on inflation. Estates less than that … no worries!

Irrevocable Trusts

In contrast to revocable trusts, where you remain in control of the assets and trust provisions during your lifetime … once executed, irrevocable trusts may not be altered. You forfeit all rights to control of assets, revision of terms or dissolution of the trust.

Without any attempt at being comprehensive, here is a listing and brief description of some trusts that may be considered. Your trust advisors will help determine what is appropriate for your needs. Descriptions for many other trusts may be found at Nolo’s Plain English Law Dictionary.

• By-pass: A trust meant for married couples to save on federal estate tax at the death of the second spouse. When the first spouse dies, the trust is split into two, one of which is called the bypass trust because the property it holds bypasses taxation when the second spouse dies.

• Charitable lead: The person who sets up the trust (grantor) transfers assets to it. Typically, the charity serves as trustee. Income from the trust assets is paid to the charity for a set period of time. Then the trust property is returned to the person who set up the trust (or another beneficiary that person named, usually the grantor's children or grandchildren).

• Charitable remainder: The grantor enjoys a tax deduction in the year assets are donated to the trust. The donor of the assets placed in the trust (or other beneficiaries named in the trust) receives trust income for a number of years or for life. At the end of the term, the assets go to a tax-exempt charity.

• Generation-skipping: The trust principal is conserved for the grantor's grandchildren. His or her children receive only income from the trust. Because the children (the middle generation) never legally own the property, it isn't subject to estate tax at their death.

• Irrevocable Life Insurance: A life insurance policy is purchased by the grantor and placed in the trust. The policy proceeds are not subject to estate tax when the original policy owner dies.

• Marital: Designed to provide benefits to a surviving spouse with the trust assets generally included in the taxable estate of the surviving spouse.

• Testamentary: A trust created by a will, effective only upon the death of the will maker.

Depending on the complexity of your estate, your desires for your beneficiaries and tax-saving issues, your team of trust advisors will work with you to craft one or more trusts that will satisfy your objectives. Your advisory team will likely enlist the aid of accounting, legal, investment and insurance professionals.

From the accounting side, we at Blair + Assoc stand ready to serve with consultation as well as filing the following documents:

• Inventories

• Court accountings

• Final income tax returns for the deceased

• Estate tax returns

• Trust income tax returns.

Finally, there are costs associated with creating and maintaining a trust. That means a conversation around ranges in cost, preparation time and ongoing administrative considerations are an excellent first step. Give us a call or drop an email to set up a no-cost initial consultation.

One last thought: we work with a number of skilled trust and estate professionals. If we can help with a referral … just ask.