Good News … Reminder for Retirees

September 2022

Earlier this year, the Blair Bulletin reported on changes to Required Minimum Distributions (RMDs) that prove to be a boon for taxpayers who can afford to delay taking money out of their IRAs, 401(K)s and other retirement accounts. Click here for a comprehensive discussion of the reason for RMDs, the new changes to the rules and 3 frequently asked questions.

The key takeaway addressed in this article is that retirees will be able to stretch the time to receive RMDs because the IRS has raised the average life expectancy from 82.4 years to 84.6. That means less money must be distributed as taxable income annually. Retirees win by a lessened tax liability plus the benefit to keep more of their assets in a tax-deferred account.

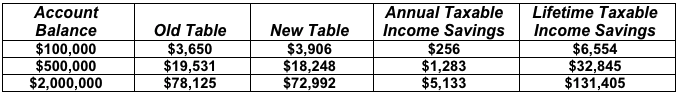

Here are examples of the RMD requirements under the old and new IRS rules.

If you choose to calculate your RMD, follow these two simple steps. First, look up the market value of your retirement account as of Dec. 31 from the previous year. Then, divide that value by the distribution period figure that corresponds with your age on the IRS Uniform Lifetime Table.

Keep in mind that your RMD is the minimum amount you must withdraw each year. You have the option to withdraw more than your minimum … just be aware that the larger your distribution, the larger your tax bill.

If any of the foregoing seems unclear as to how it applies to your specific circumstances, please keep in mind that Blair + Assoc will help. Give us a call or drop an email. We’ll respond immediately.